IEDM – Gains en capital: «Ça va limiter l’accès à l’entreprenariat» – Emmanuelle B. Faubert

April 23, 2024 | 05 min. 10 sec. | Yasmine Abdelfadel (QUB Radio) Interview (in French) with Emmanuelle B. Faubert, Economist at the […]

4-minute read

L’augmentation de l’impôt sur le gain en capital va affecter négativement la classe moyenne et l’entrepreneuriat

Cette mesure fiscale ne va ultimement générer que peu ou pas de recettes additionnelles pour le Trésor public en plus de nuire à l’entreprenariat, à la croissance économique et au bien-être de nombreux gens de classe moyenne.

5-minute read

Budget fédéral 2024: l’art de se tirer dans le pied

Que ce soit en matière de logement ou en matière de productivité et d’investissement, le gouvernement Trudeau sait bien identifier les problèmes. Malheureusement, avec les solutions proposées dans le plus récent budget, il risque fort de les exacerber.

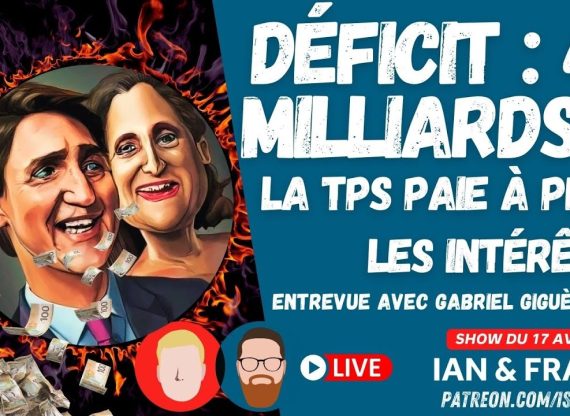

IEDM – Déficit de 40 milliards $: «La TPS paie à peine les intérêts de la dette» – Gabriel Giguère

Interview (in French) with Gabriel Giguère, Public Policy Analyst at the MEI, about the Trudeau government 2024-2025 budget. Broadcast on April 17, 2024 as part of the Ian & Frank podcast.

IEDM – Sous le gouvernement Trudeau, on a un réel problème de dépenses – Gabriel Giguère

April 17, 2024 | 12 min. 01 sec. | Mathieu Bock-Côté (QUB Radio) Interview (in French) with Gabriel Giguère, Public Policy Analyst […]

3-minute read

Federal budget: You can’t solve a productivity emergency with tax hikes

Montreal, April 16, 2024 – The increase in the capital gains tax inclusion rate will further exacerbate Canada’s productivity lag, asserted the Montreal Economic Institute in response to the publication of the federal budget this afternoon.

IEDM – Il faudrait couper jusqu’à 15 000 fonctionnaires – Gabriel Giguère

March 29, 2024 | 11 min. 08 sec. | Richard Martineau (QUB Radio) Interview (in French) with Gabriel Giguère, Public Policy Analyst […]

4-minute read

Dear Ontario: Corporate subsidies aren’t the path to prosperity

It’s time for Premier Doug Ford to end government handouts and chart a bold new course by cutting corporate welfare and lowering corporate taxes.

MEI – Ballooning Public Service – Renaud Brossard

Interview with Renaud Brossard, Vice President, Communications at the MEI, about a recent MEI report ranking the five major prime ministers who have held power since 1984 based on the variation in the number of federal public servants per 1,000 inhabitants during their mandates and why a rapidly expanding civil service is a cause for concern. Published on Conversation That Matters on March 22, 2024.

MEI – What solutions will an economically liberal philosophy bring to Canada? – Daniel Dufort

March 21, 2024 | 8 min. 06 sec. | The Elias Makos Show (CJAD AM) Interview with Daniel Dufort, President and CEO of […]