Internal Trade Provincial Leadership Index – 2023 Edition

Economic Note updating our ranking of Canada’s provinces and territories in terms of their openness to internal free trade, and also examining their barriers to labour mobility

Quebec is the Canadian jurisdiction that is most closed off to interprovincial trade, according to the most recent edition of the Montreal Economic Institute’s Internal Trade Provincial Leadership Index.

Related Content

Related Content

This Economic Note was prepared by Krystle Wittevrongel, Senior Policy Analyst & Alberta Project Lead at the MEI, and Gabriel Giguere, Public Policy Analyst at the MEI. The MEI’s Regulation Series aims to examine the often unintended consequences for individuals and businesses of various laws and rules, in contrast with their stated goals.

In recent years, internal trade has become one of the most important discussion points among the Premiers of Canada’s provinces and territories—and for good reason, as it contributes to economic growth and accounts for nearly a fifth of the country’s GDP.(1) Yet, barriers to free interprovincial trade remain,(2) adding 7% to the costs of goods and services.(3) With concerns about inflation and affordability top of mind for many, here is the third edition of our Internal Trade Provincial Leadership Index.

Internal Trade: Retrospective and New Ranking

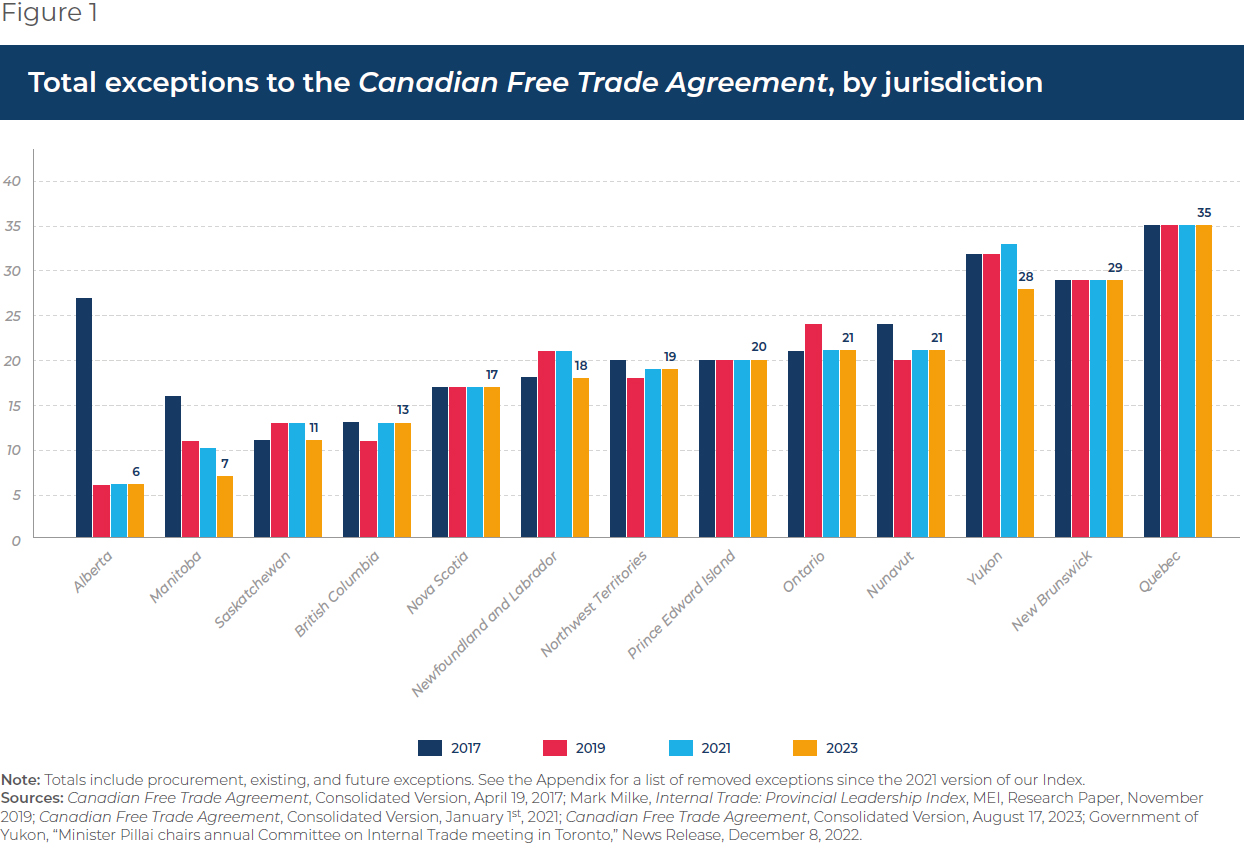

Our inaugural Internal Trade Provincial Leadership Index was developed and launched in 2019.(4) We ranked the provinces and territories by number of existing barriers to interprovincial trade, as quantified by explicit exceptions to the Canadian Free Trade Agreement (CFTA). At the time, Alberta was the clear leader and Quebec was in last place.(5) In 2021, we published a second edition of the Index, assessing progress made by provinces and territories since 2019. A few jurisdictions had removed some exceptions to the CFTA, while others had actually added exceptions. Alberta was still in first place, and Quebec was still last.(6)

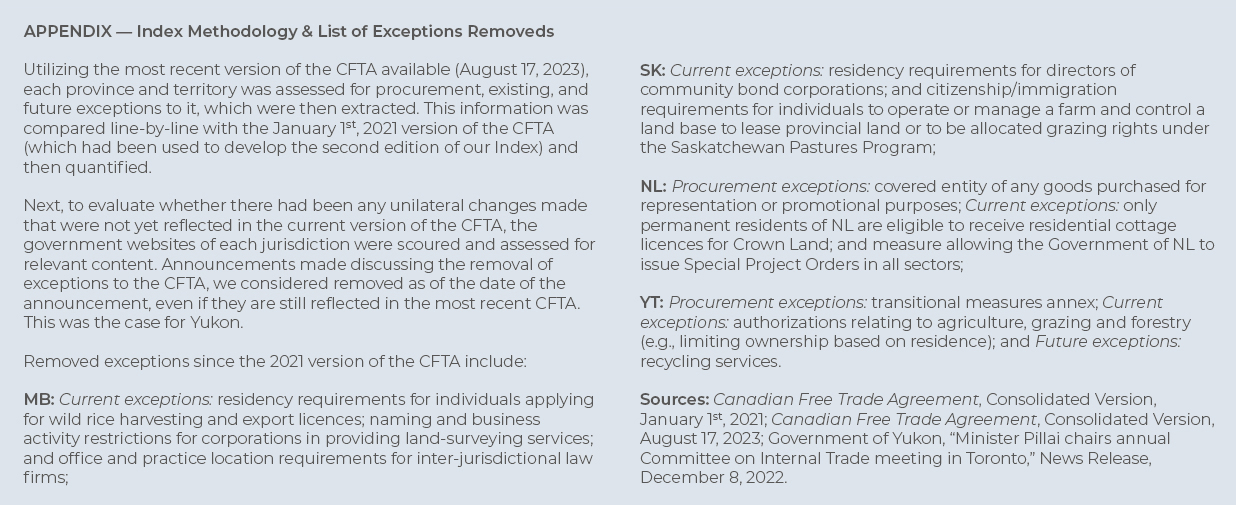

Now, in this third edition, we are once again assessing the unilateral moves made by provinces and territories in the spirit of fostering interprovincial trade. Four jurisdictions—Manitoba, Saskatchewan, Newfoundland and Labrador, and Yukon—have reduced their number of explicit exceptions to the CFTA since our previous edition two years ago (see Figure 1).

The bookends to the Index remain the same: Alberta leads and Quebec is the laggard. Alberta has consistently held its leading position on our Index, following the elimination of a large number of its exceptions soon after the CFTA came into effect in 2017. Quebec has yet to eliminate a single exception, maintaining its 35 total exceptions—nearly six times as many as first place Alberta.

Of the other jurisdictions, Manitoba in particular has made significant strides in curtailing its barriers to interprovincial trade once again, and remains in second place in our Index for this reason.(7) Saskatchewan, after adding a couple of exceptions early on, has now returned to the same number of exceptions it had in 2017. Saskatchewan now holds the third spot alone, whereas it previously shared that rank with British Columbia, now in fourth.(8) Newfoundland and Labrador removed three exceptions and moved up two spaces in our ranking since 2021, from 8th place to 6th. And although in third to last place in our ranking, Yukon has made strides that are worthy of acknowledgement. Previously having added an exception to the CFTA (between 2019 and 2021), Yukon has reversed course and removed five of its exceptions since 2021.(9)

Manitoba in particular has made significant strides in curtailing its barriers to interprovincial trade once again.

Other jurisdictions have added exceptions at some point in time and then removed others, or vice versa, with some of these ending up exactly where they began in terms of total exceptions, and others having a somewhat lower number. Three provinces besides Quebec have maintained the status quo over the past six years with no movement whatsoever: New Brunswick, Prince Edward Island, and Nova Scotia.

Quantifying the degree of free trade within Canada based on the number of exceptions to the CFTA has its limitations, of course. For one thing, the exceptions are not all equal in terms of scope or their associated costs. For another, there is more to be said about internal labour mobility, as we shall see in the next section.

Empowering Canada’s Workforce through Enhanced Labour Mobility

One important aspect of internal free trade is labour mobility, which is the ability of workers to move freely between provinces and territories without needing significant additional training, work experience, examination, or assessment. According to the Heritage Foundation’s Index of Economic Freedom, Canada ranks 16th out of 176 countries in terms of labour freedom,(10) the same as its overall economic freedom ranking. However, Canada’s labour freedom score has fallen 18.1% since 2006 (faster than the world average, which fell 8.7% over the same period).(11) Additionally, a recent measure of the average annual regional migration rate in Canada (between 2013 and 2016) found that it was well below the OECD average.(12) This underperformance raises significant concerns, as it undermines the growth prospects of provinces that impose barriers to labour mobility and negatively impacts the country’s economic development potential.

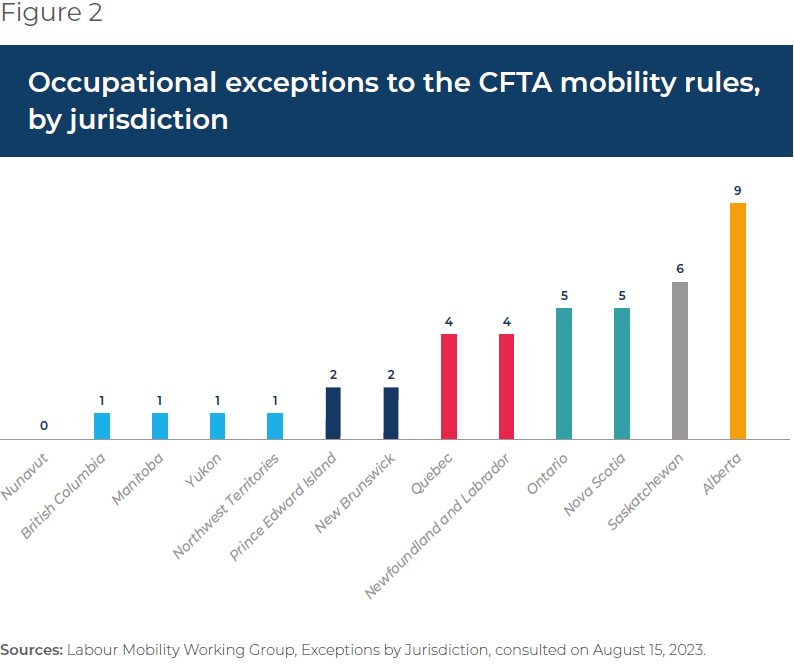

The non-recognition of qualifications is an important and persistent issue for labour mobility, as indicated by the OECD’s 2023 Economic Survey of Canada.(13) The CFTA has a chapter dedicated to labour mobility, which aims to ensure that workers certified or licensed by one regulatory authority can be recognized as qualified by other jurisdictions.(14) This applies broadly to all professions, except for a small number of exceptions in which there are significant variations in occupational standards between some provinces and territories. These exceptions are not to the CFTA itself, and are therefore not included in the above index. Rather, they are exceptions noted by the Labour Mobility Working Group, established under the CFTA, that jurisdictions continue to review and update over time.(15)

While Alberta continues to lead in terms of openness to interprovincial trade, it has some work to do when it comes to labour mobility.

While Alberta, as noted, continues to lead in terms of openness to interprovincial trade as measured by exceptions to the CFTA, it has some work to do when it comes to labour mobility. Indeed, Alberta is the jurisdiction with the most barriers to labour mobility as quantified by number of occupational exceptions to the CFTA mobility rules (see Figure 2).

The government of Alberta recently passed the Labour Mobility Act, with the objective of streamlining the mobility of skilled Canadians in more than a hundred regulated occupations.(16) Although this legislation is a step in the right direction, more needs to be done. This is especially true given that a number of Alberta’s barriers to labour mobility apply to health professionals (dental hygienists, licensed practical nurses, medical radiation technologists, nurse practitioners, paramedics, and podiatrists), and the shortage of such professionals in the province has reached crisis levels, especially in rural areas.(17) In addition, Canadians are moving to Alberta in record numbers.(18) To make the best use of its resources, these occupational exceptions must be rectified.

Labour mobility not only allows for an increase in the volume of interprovincial trade, but it also enhances productivity.(19) Another benefit is the shrinking of wage gaps, as worker movement diminishes productivity disparities.(20) Budget 2023 contained commitments to improve labour mobility in Canada, including the development of a Federal Framework on Mutual Recognition. The goal is to outline a coordinated policy approach and engage provinces and territories to strengthen labour mobility and internal trade in Canada.(21) This framework should encompass, at a minimum, a robust, uniform mechanism for assessing and recognizing credentials, accompanied by clear guidelines for professional regulatory bodies. In addition, incorporating transition periods and ensuring that confidence-building mechanisms exist among regulators has been shown to encourage successful trade and labour mobility liberalization.(22)

Mutual recognition across Canada could achieve long-term increases in GDP of between 4.4% and 7.9%, or between $2,900 and $5,100 per Canadian.

Recent research shows that mutual recognition across Canada could achieve long-term increases in GDP of between 4.4% and 7.9%, which means between $110 billion and $200 billion per year, or between $2,900 and $5,100 per Canadian.(23) For Alberta, this works out to gains of between $2,300 and $3,000 per capita.(24) Clearly, the benefits of mutual recognition are substantial.

Conclusion

Enhancing internal trade among Canada’s provinces and territories continues to present a challenge, despite the potential benefits. Positive strides have been made by Manitoba, Saskatchewan, Newfoundland and Labrador, and Yukon, with each making some headway in reducing exceptions to the CFTA since our previous edition two years ago. Conversely, the lack of improvement in Quebec and elsewhere is disappointing. And while Alberta continues to lead in terms of number of exceptions to the CFTA, the inclusion of barriers to labour mobility in this edition paints a more nuanced picture.

Provincial and territorial governments should adopt a more focused approach to liberalizing internal trade and unifying the Canadian market. Removing barriers and improving labour mobility, notably through mutual recognition agreements, could increase productivity and grow GDP, to the clear benefit of all Canadians. But to be successful, these agreements need to have sustained political leadership and oversight. The federal government’s commitment to developing a Federal Framework on Mutual Recognition needs the buy-in of provincial and territorial governments in order to contribute to a more resilient and prosperous Canadian economy.

References

- Ryan Manucha and Trevor Tombe, Liberalizing International Trade through mutual recognition, MacDonald Laurier Institute, September 2022, p. 4; Canada’s Premiers, Internal Trade, consulted on August 15, 2023.

- OECD, OECD Economic Surveys: Canada 2023, March 6, 2023, pp. 41-42.

- Robby K. Bemrose, W. Mark Brown, and Jesse Tweedle, Going the Distance: Estimating the Effect of Provincial Borders on Trade when Geography Matters, Statistics Canada, September 14, 2017, pp. 30-31, 33. There have been changes at provincial and territorial levels since this 2017 study that may impact this estimate slightly.

- In collaboration with the Canadian Constitution Foundation.

- Mark Milke, Internal Trade Provincial Leadership Index, MEI, Research Paper, November 2019.

- Olivier Rancourt and Krystle Wittevrongel, Internal Trade Provincial Leadership Index – 2021 Edition, MEI, Research Paper, March 2021, p. 18.

- Province of Manitoba, “Manitoba Government Reducing More Barriers to Canadian Internal Trade,” News Release, January 12, 2023.

- Olivier Rancourt and Krystle Wittevrongel, op. cit., endnote 6.

- Government of Yukon, “Minister Pillai chairs annual Committee on Internal Trade meeting in Toronto,” News Release, December 8, 2022.

- Labour freedom includes “the ability of individuals to find employment opportunities and work” as well as “the ability of businesses to contract freely for labour and dismiss redundant workers,” and so is broader than labour mobility. Anthony B. Kim, 2023 Index of Economic Freedom, The Heritage Foundation, 2023, pp. 4, 15, 88-89.

- Canada’s score fell from 84.2 to 69.0, while the world average fell from 60.9 to 55.6. The Heritage Foundation, 2023 Index of Economic Freedom, Graph the Data, consulted September 18, 2023; The Heritage Foundation, Graph the Data, Labor Freedom, consulted September 18, 2023; The Heritage Foundation, 2023 Index of Economic Freedom, Explore the Data, consulted October 10, 2023.

- OECD (2018), Regions and Cities at a Glance (database), cited in Müge Adalet McGowen and Juan Antona San Milan, Reducing regional disparities for inclusive growth in Spain, OECD Economics Department Working Papers No. 1549, May 15, 2019, p. 19.

- OECD, op. cit., endnote 2.

- Canadian Free Trade Agreement, Consolidated Version, January 31, 2023. pp. 83-84.

- Labour Mobility, Exceptions to Labour Mobility, consulted on August 15, 2023; Labour Mobility, Exceptions by Jurisdiction, consulted on August 15, 2023.

- Province of Alberta, Labour Mobility Act, April 6, 2023; Government of Alberta, Labour mobility within Canada, consulted October 10, 2023.

- Emily Mertz, “Alberta union raises alarm over health-care staffing shortage: ‘The crisis is not over,’” CBC News, April 18, 2023.

- David Staples, “Canadians voting with their feet and they’re picking Alberta,” Edmonton Journal, June 30, 2023.

- Aziz Nusrate and Gerry Mahar, “Labour mobility and interprovincial trade in Canada,” EconStor, GLO Discussion Paper, No. 341, Global Labor Organization (GLO), Essen, p. 1; Müge Adalet McGowen and Juan Antona San Milan, op. cit., endnote 12, p. 18.

- Orsetta Causa, Nhung Luu, and Michael Abendschein, Labour Market Transitions Across OECD Countries: Stylised Facts, OECD Economics Department Working Papers No. 1692, December 10, 2021, p. 7.

- Government of Canada, Budget 2023: A Made-in-Canada Plan, 2023, p. 98.

- Carreito et al., 2016, as cited in Ryan Manucha and Trevor Tombe, op. cit., endnote 1, p. 26.

- Ibid., p. 5.

- Unilateral moves still result in GDP gains, although more limited than broader mutual recognition. For example, Alberta would gain about 2/3 that of the all-province liberalization. Ibid.,pp. 37-39.