Environmental Policies Should Be Adapted for Rural Canadians

Economic Note showing that rural communities often bear a higher share of the cost of measures aimed at mitigating environmental harm

For many years, governments have been piling measure upon measure to reduce greenhouse gas emissions, all in an effort to fight climate change. This Economic Note published by the MEI analyzes the extent to which these public policies have a disproportionate impact on the country’s rural regions.

Related Content

Related Content

|

|

|

| Instaurer des politiques environnementales sans pénaliser nos régions (Le Journal de Montréal, September 2, 2021)

La taxe carbone au détriment des régions comme Vaudreuil-Soulanges (NéoMédia, September 2, 2021) Reducing our emissions without penalizing rural regions (iedm.org, September 6, 2021) |

Interview with Krystle Wittevrongel (The Roy Green Show, Global Radio, September 4, 2021) |

This Economic Note was prepared by Olivier Rancourt, Economist at the MEI, Krystle Wittevrongel, Public Policy Analyst at the MEI, and Miguel Ouellette, director of Operations and Economist at the MEI. The MEI’s Environment Series aims to explore the economic aspects of policies designed to protect the natural world in order to encourage the most cost-effective responses to our environmental challenges.

The climate change conversation is generally focused on between-country and global disparities,(1) as the repercussions are regressive, falling more heavily on the poor.(2) However, this is also true within countries, and even within single provinces. Rural Canadians are more heavily affected by climate change in the form of rising temperatures, changing precipitation patterns, and extreme weather conditions.(3) Rural Canadians also earn incomes that are typically 16% lower than their urban counterparts, have higher unemployment rates, and see slower income growth than urban areas.(4) Regrettably, in addition to rural areas suffering the consequences of climate change more severely, they also more often bear a higher share of the cost of public policies and measures aimed at mitigating environmental harm.

Public policies aimed at combatting climate change and other environmental ills have the potential to amplify the inequalities between rural and urban areas across Canada. These policies need to undergo rigorous cost-benefit analysis to better appreciate the unintended consequences that they can have on the economic development and welfare of communities in general, and rural communities in particular. It is undeniable that problems like climate change must be addressed. However, environmental policies should not be crafted only thinking of citizens living in urban areas; they need to consider the unique realities faced by rural residents.

Here, we highlight three areas of environmental public policy in Canada that have the effect of amplifying the inequalities that exist between rural and urban areas. First, there is the disproportionate impact of carbon pricing schemes if they are not carefully designed. Second, there is the moratorium on developing natural gas in the province of Quebec, which is felt primarily in rural areas where this resource is located. And third, there is the overregulation that complicates the repurposing of oil and gas projects in Alberta, which has contributed to economic disparities in the province.

Canada’s federal government has stated that “[w]e cannot have a prosperous country without successful, competitive, and thriving rural communities.”(5) In order to ensure better economic opportunities for rural communities and to reduce the negative effects on poorer populations, these kinds of regulations need to be reassessed.

The Disproportionate Impact of the Carbon Tax

In 2016, the federal government announced its carbon pricing plan aimed at meeting greenhouse gas (GHG) emission reduction targets,(6) and in 2018, The Greenhouse Gas Pollution Pricing Act was passed.(7) This Act applies a federal carbon tax to the four provinces which lacked provincial carbon taxes at the time, and a benchmark minimum for other provinces to follow in their carbon tax schemes.(8) The Pan-Canadian Approach to Pricing Carbon Pollution benchmark includes pricing based on GHG emissions through either an explicit price-based system (such as British Columbia’s carbon tax) or a cap-and-trade system (such as Quebec’s).(9) It essentially establishes a minimum price applied through taxes on all carbon emitting sources in Canada, and there are legislated annual increases in pricing.(10)

Under the federal carbon tax, revenues are under provincial jurisdiction and are to be returned to the jurisdiction of origin, with provincial governments having control over their use.(11) These taxes are returned to residents as tax-free Climate Action Incentive payments redeemed at tax filing, and vary according to a number of factors—one of which is rurality.(12) Residents of rural areas can claim an additional 10% in recognition of their specific needs. However, provinces with their own carbon tax systems, such as British Columbia and Quebec, are exempt from the federal tax. Therefore, Quebec can continue to use its current carbon pricing mechanism which, unlike the federal system, is neither fiscally neutral(13) nor modulated for cost of living.(14) More specifically, it does not take into account the reality of citizens living in rural areas, who constitute nearly 20% of the population.(15)

While most of these costs are burdens on producers, it is ultimately consumers who pay the price. The goal is to change behaviour and encourage consumers and producers to favour products that emit less GHGs by increasing the prices of the alternatives that emit more. However, not all day-to-day products have an accessible alternative or substitute. Take transport fuel, for example. As of 2022, the carbon tax alone is positioned to increase the price of such fuel in Quebec by 11.63 cents per litre.(16)

While this policy might not seem harmful at first glance, it’s important to understand that for most people, fuel is a very inelastic good.(17) This means that a variation in the price of a good will not be followed by the same magnitude of variation in its demand. In this case, raising the price of fuel will not significantly reduce the amount of it that consumers will purchase.

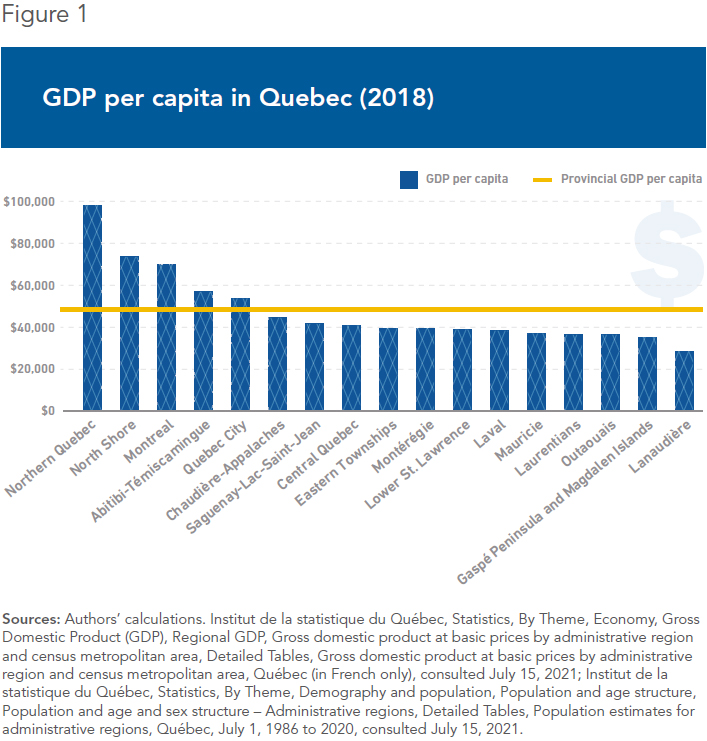

The reason for this inelasticity is that few alternatives to the use of automobiles exist in less densely populated areas. In Quebec, 99% of public transport trips are provided by ten public transit organizations.(18) As many people can’t afford to trade in their car for a newer fuel efficient or electric model, the impact of the carbon tax differs by region. Some regions with more wealth (see Figure 1) or better access to more efficient public transit systems can adapt to this price increase accordingly, but those with fewer alternatives are less able to adapt and are therefore stuck paying higher prices.

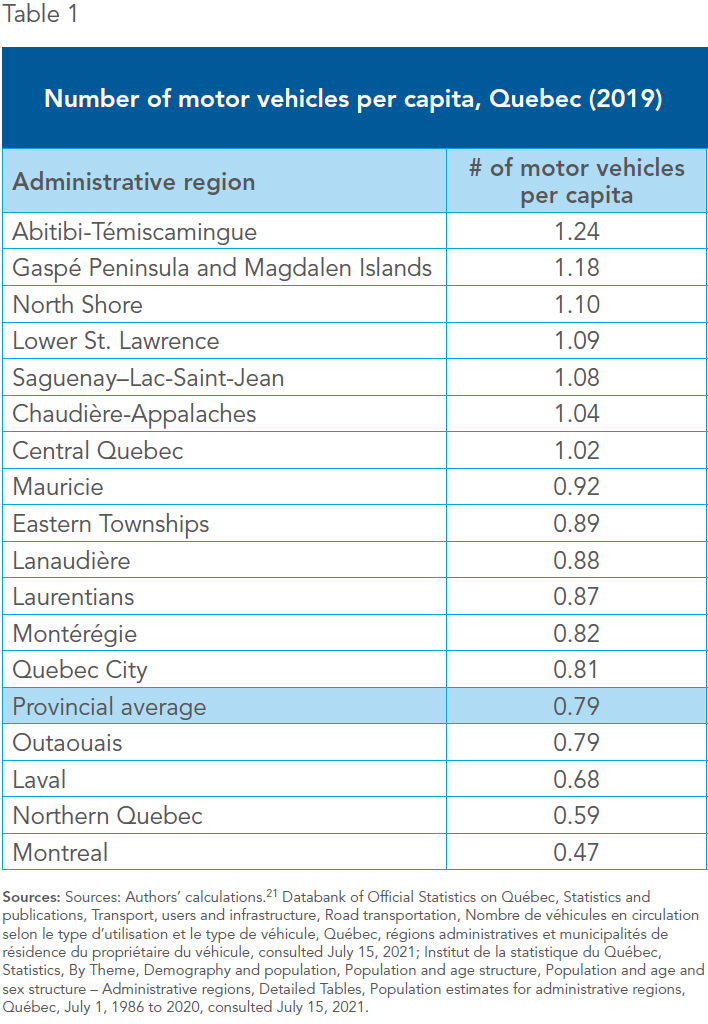

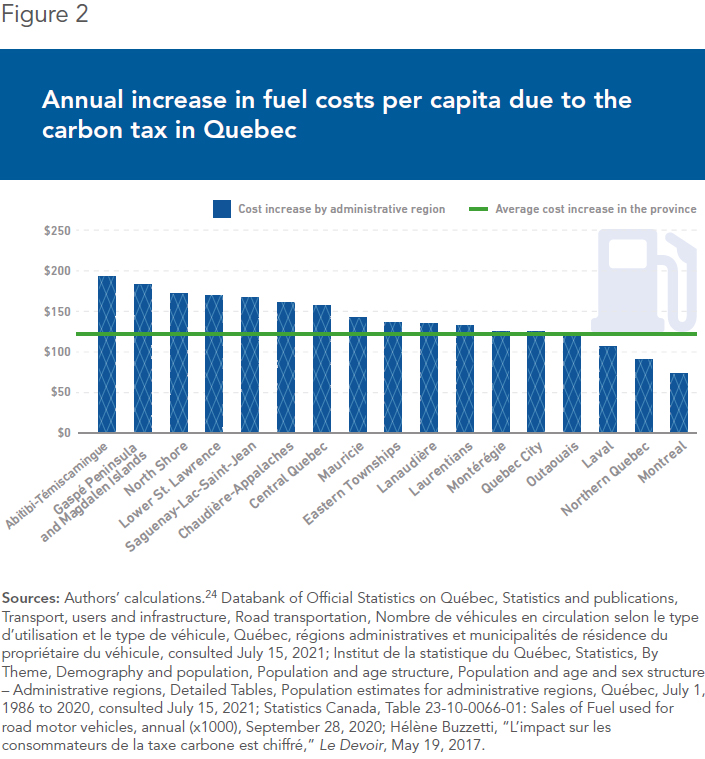

Consequently, in many rural areas, carbon pricing will not reduce demand as much as in urban areas, even with the same price increase applied. It will simply increase out-of-pocket expenses for consumers in rural areas who have fewer transportation options. In addition, transportation already consumes a larger proportion of household spending in rural areas.(19) Regions like Montreal and Laval, whose residents have access to comprehensive public transit systems, have fewer motorized vehicles per capita than rural regions where public transit access is spotty (see Table 1).(20)

In agricultural regions, farmers also need fuel to operate tractors and other motorized vehicles, thus increasing their carbon tax burden even further. As urban centres tend to be more prosperous than rural regions, wealth disparities across regions will tend to become even more pronounced. In its current form, Quebec’s carbon pricing mechanism simply places more of a burden on poorer regions than it does on richer regions.

One easy solution to this pricing problem would be to modulate the cost of Quebec’s provincial “carbon tax” on a sliding scale, based on degree of rurality of taxpayers. While this proposed tax scheme would lower the financial burden on rural households, the purpose of the tax—to reduce the emission of GHGs—would stay the same. In short, such new pricing would be more equitable and would take into account the regional disparities within the province due to the unique circumstances of rural residents, while still furthering the province’s environmental aims.

It is also important for carbon taxes to be fiscally neutral. A revenue-neutral carbon tax is one that is redistributed integrally through tax rebates back to individual taxpayers or businesses, much like the federal carbon tax system. This lowers the impact of the tax on the taxpayer, while still providing incentives for consumers to move away from goods that emit more GHGs. Quebec’s carbon pricing, however, is not revenue neutral.(22) All the income generated by the carbon tax flows into the Electrification and Climate Change Fund,(23) which is then used in part to subsidize cleaner goods, creating even further distortions in the market.

The federal carbon tax’s revenue-neutral scheme, however, is not perfect. As seen in Figure 2, not all rural regions in Quebec are impacted equally by the tax, and therefore even with an additional 10% for rural residents, as is done federally, there would still be disadvantages among regions which are paying more of the tax on average.

Therefore, variables such as the actual area of residence (by dissemination area(25)) and the income of consumers need to be taken into account when creating a fiscally neutral carbon tax. In its current form, Quebec’s system of carbon pricing falls short, intensifying economic disparities between individuals from rural and urban areas.

The Natural Gas Moratorium in Quebec

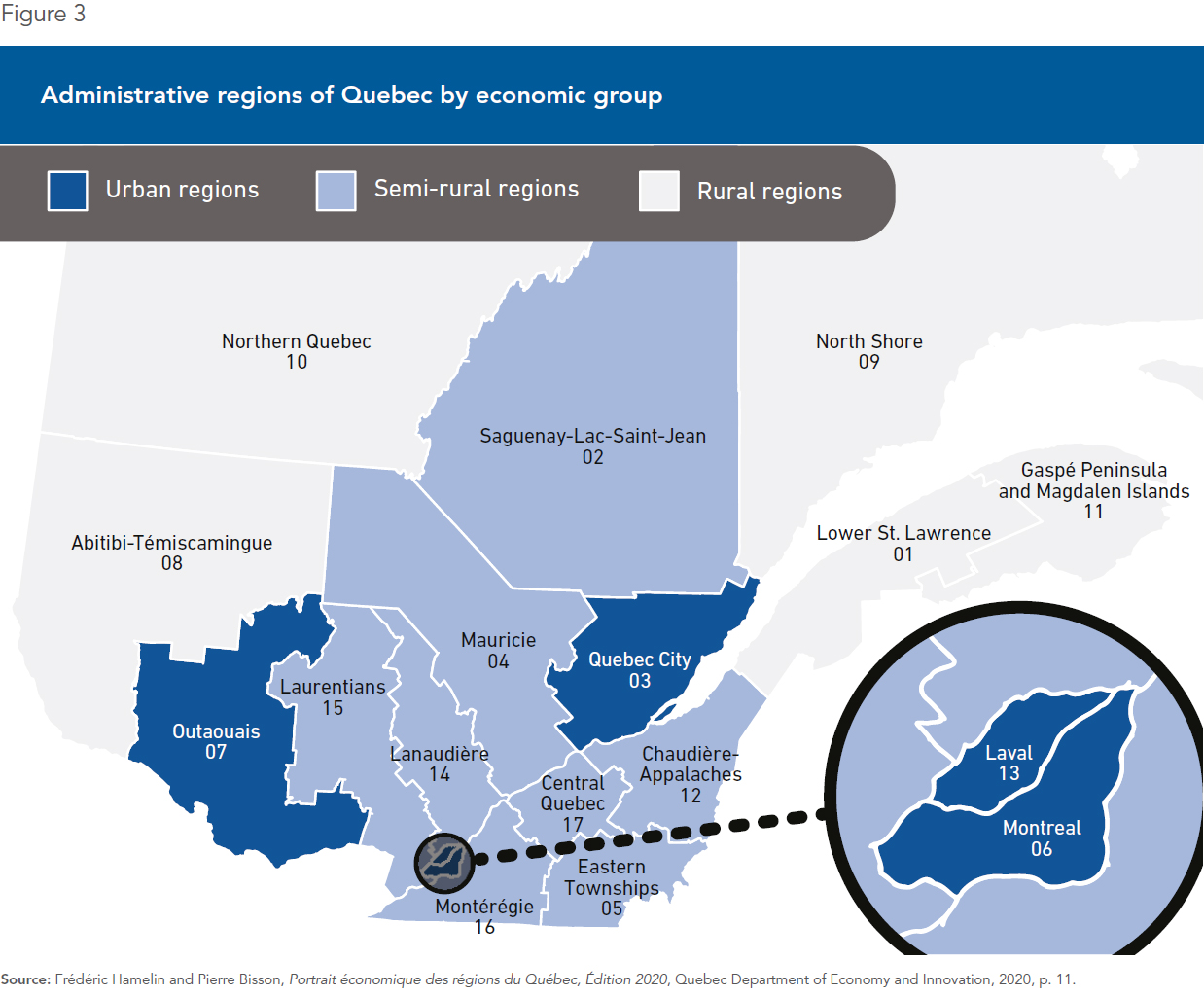

Another way to reduce overall economic disparities is to create jobs and wealth in poorer regions. The province of Quebec has estimated natural gas reserves of between 2.8 trillion and 8.5 trillion cubic metres.(26) To give some sense of just how much natural gas is present in the province, it would fill between 2.8 billion and 8.5 billion Olympic-sized swimming pools.(27) These reserves are mostly located in the St. Lawrence Lowland, inside a geological region called the Utica Shale, with other significant sources in the Macasty Shale near Anticosti Island and in the Gaspé region. As can be seen in Figure 3, these regions are considered rural regions.

Despite these large reserves, a five-year moratorium on fracking was put in place in 2013.(28) In 2016, the ban was extended(29) and the Quebec government forbade all gas development that requires fracking into shale(30) or that is close to a body of water.(31) The official rationale for this moratorium is again to fight climate change by reducing GHG emissions.

It is estimated that if natural gas restrictions were lifted for a 25-year period, the province could bring in close to $15 billion in tax revenue and mining royalties, would gain a total of $93 billion in GDP,(32) and would see the creation of 230,000 person-years of employment.(33) A person-year is an accounting term which describes the amount of labour one person can complete in one year.(34) In other words, lifting the restrictions related to the production and extraction of natural gas for 25 years would generate enough labour, to take the most extreme example, for one person to work 230,000 years. More realistically, these regulatory barriers are preventing the creation of 25 years of labour for 9,200 people.

What’s more, most of these jobs would be created in gas-dense regions, meaning semi-rural areas within the Utica Shale, like Montérégie, Central Quebec, and Chaudière-Appalaches,(35) and in those with large reserves in rural areas like the Gaspé Peninsula and the Lower St. Lawrence.(36)

Most of these jobs, and the subsequent wealth creation, would therefore be in the have-not regions of the province, specifically in rural areas. One of the regions that would benefit the most is the Gaspé Peninsula, which has had an average unemployment rate of 13.5% over the past five years, compared to a provincial rate of 6.3%. The situation is even worse when you consider that, because of the aging population and the exodus of its youth, the mean employment rate over that same period has been only 45.6%, compared to a provincial average of 60.6%.(37)

By outlawing fracking, the government has erected a barrier to economic development and wealth creation in less prosperous regions of the province. Rural regions with a heavy focus on resource development, such as Abitibi-Témiscamingue, the North Shore, and Northern Quebec, outpace both urban centres and the provincial average in terms of GDP per capita.

Moreover, the recent decision by the Quebec government to reject(38) GNL Québec’s Énergie Saguenay Project, “an innovative, carbon-neutral hydro-powered liquefied natural gas (‘LNG’) export project,”(39) is another constraint on the economic growth of Quebec’s rural regions. This project would have represented the largest private investment in the history of the province,(40) created thousands of jobs in the Saguenay region,(41) and contributed to the reduction of global GHG emissions.(42) This is in addition to the fact that residents in the region and municipal representatives supported the project. The decision is all the more disappointing given that the Saguenay has a GDP per capita well below the provincial average, and an unemployment rate that has constantly been among the highest in the province in recent years.(43)

Worse still, leaving natural gas in the ground will only delay the move away from the use of coal power plants in countries that could use our cleaner resource instead. Unlike carbon taxes, therefore, the Quebec government’s natural gas moratorium and its rejection of liquid natural gas infrastructure do not even achieve any clear environmental objective. The overregulation of natural gas in the province has thus ignored an opportunity to increase overall prosperity and job creation in rural areas, and to ease disparities that exist between the poorer and richer regions of the province, all for no clear purpose.

The Regulatory Web of Repurposing Oil and Gas Infrastructure in Alberta

Poor regulatory coordination and policy murkiness surrounding the repurposing of oil and gas projects in Alberta is another area where regulations have contributed to economic disparities intraprovincially—and again without any clear environmental benefit. Various regulators are responsible for different parts of the problem, so they need to come together with the provincial government to determine ways to fix the rules that have historically prevented progress.(44)

The current regime allows for reclamation and remediation, but not for the repurposing of the land.(45) Thus, rather than a host of new regulations, a process approach is needed to cut through the red tape associated with this issue.

There are approximately 97,000 inactive wells and 71,000 abandoned wells across Alberta which actually pose serious environmental, financial, and health risks to Albertan landowners.(46) As oil and gas development occurs almost exclusively in rural Alberta, rural landowners are unfairly saddled with the repercussions and costs of this dormant infrastructure.(47)

Many of these sites could be repurposed by energy entrepreneurs for alternative energy uses, including geothermal, micro-solar, hydrogen, recovery of lithium or other minerals, or carbon capture and storage.(48) Not only could repurposing these sites return them to productive uses, but expanding on existing oil- and gas-related resources has the potential to redeploy workers who have suffered from the oil and gas slump and create jobs in rural regions specifically.

Efforts have been made by several companies to repurpose existing infrastructure, only to be met with regulatory hurdles. For example, it took one project over five years to wade through the layers of regulations in repurposing legacy oil and gas infrastructure for community solar power.(49) That’s five years of rural Albertans missing out on economic and environmental improvement opportunities. Another company attempted to repurpose existing infrastructure to generate geothermal energy, and the regulatory labyrinth has taken longer than it would have if they had broken new ground rather than attempt to minimize environmental disturbance by repurposing.(50)

These sites, on already-disturbed (brownfield) land, reduce new developments of greenspace, and with electricity grid tie-ins, roads, and other infrastructure in place, also reduce the need for further environmental disturbance.(51) But energy entrepreneurs have been unable to capitalize on this opportunity to create jobs and help diversify the energy sector due to inflexible regulations that do not allow for site repurposing, as well as a lack of clarity and collaboration among regulators.(52) As a result, rather than turning a liability into an asset, rural landowners and farmers pay the price.

About 10% of inactive wells leak pollutants, imposing a significant negative burden on nearby rural communities.(53) For one, these sites may negatively impact the value of a property and its owner’s ability to sell or develop it.(54) For example, the small town of Calmar about 50 km southwest of Edmonton has 130 acres of prime real estate it would like to develop that backs onto a rail line and is located right off the main highway.(55) This development would not only bring modern industry to the area, but would also employ hundreds of people. However, due to the unknown level of contamination, developers avoid the risky property, which has been vacant for decades.(56)

In addition, inactive or orphaned wells on farmland may negatively impact the ability of farms to attract or maintain distributors or customers as the potential for soil contamination, real or perceived, may impact market competitiveness.(57) Farmers may also make crop decisions around the issue of potential contamination, forgoing the prospect of lucrative specialty crops.(58)

While these costs are likely immense, they are difficult to quantify. Fears of further land devaluation in the case of orphan wells or contamination, or the potential risk to future compensation for existing wells if they speak out publicly, make many farmers and other rural citizens reluctant to discuss these issues.(59)

In addition to the very real possibility of crop contamination and further implications for farming, these communities suffer from potential soil and water contamination that can accumulate in nearby areas and pose health risks.(60) In fact, Albertans have attributed chronic health problems and even deaths to leakages from orphaned wells.(61)

It is evident that the negative consequences of the regulatory burden associated with repurposing these abandoned and orphaned wells fall more heavily on rural communities. Diversifying the energy sector and developing alternative energy sources will help reduce the negative environmental and health impacts on rural communities, as well as reduce the risk of land devaluation and possibly lead to increased yields for farmers or the harvest of more profitable specialty crops.

Moving Forward in the Fight against Climate Change

While climate change needs to be addressed, politicians should not be given a free pass when it comes to environmental policies. These policies should not be crafted only with the needs of urban dwellers in mind, and they should have a clear environmental purpose that justifies their costs. As we have illustrated, Quebec’s system of carbon pricing and its overregulation of natural gas have intensified economic disparities between individuals from rural and urban areas, while the regulatory burden involved in repurposing oil and gas wells in Alberta has similarly penalized rural communities.

One fifth of all Canadians live, work, and thrive in rural areas,(62) and consultation with these rural Canadians has emphasized the fact that government policies have to meet their unique needs while protecting against climate change.(63) Therefore, the regulations examined above need to be amended to address the inherent costs to rural communities while ensuring enhanced economic opportunities and reducing intraprovincial disparities. And those that cannot survive a rigorous cost-benefit analysis should be scrapped altogether.

References

- Noah S. Diffenbaugh and Marshall Burke, “Global warming has increased global economic inequality,” Proceedings of the National Academy of Sciences of the United States of America, Vol. 116, No. 20, 2019, p. 9808.

- Emmanuel Skoufias (ed.), The Poverty and Welfare Impacts of Climate Change: Quantifying the Effects, Identifying the Adaptation Strategies, The World Bank, 2012, p. 6.

- Amy Kipp et al., “At-a-glance – Climate change impacts on health and wellbeing in rural and remote regions across Canada: A synthesis of the literature,” Health Promotion and Chronic Disease Prevention in Canada, Vol. 39, No. 4, April 2019, p. 122.

- Sébastien Breau and Richard Saillant, “Regional income disparities in Canada: exploring the geographical dimensions of an old debate,” Regional Studies, Regional Science, Vol. 3, No. 1, November 28, 2016, p. 468; Government of Canada, Rural Opportunity, National Prosperity: An Economic Development Strategy for Rural Canada, June 2019, p. 5.

- Government of Canada, ibid., p. 3.

- Sebastian Leck and Shawn McCarthy, “Carbon Pricing in Canada,” The Canadian Encyclopedia, April 13, 2021.

- Maxine Joselow, “National Carbon Tax Upheld by Canada’s Supreme Court,” Scientific American, March 29, 2021.

- These four provinces were Manitoba, Ontario, Saskatchewan, and New Brunswick. Currently, the federal backstop is in place in Manitoba, Ontario, Yukon, and Nunavut. Government of Canada, Environment and natural resources, Weather, climate and hazards, Climate change, Canada’s climate plan, Carbon pollution pricing, Carbon pricing across Canada, Carbon pollution pricing systems across Canada, consulted July 13, 2021.

- Price-based systems like BC’s impose a direct price on each tonne of emissions resulting from the combustion of fossil fuel. Cap-and-trade systems like QC’s see the government putting a limit on the overall amount of carbon emissions while also permitting the purchase and sale by companies that exceed their quota of emission credits from companies with unused quota. Government of Canada, Environment and Climate Change Canada, Pan-Canadian Approach to Pricing Carbon Pollution, consulted July 16, 2021.

- Government of Canada, Environment and natural resources, Climate change, Canada’s climate plan, Carbon pollution pricing, Carbon pollution pricing systems across Canada, Additional information on the federal carbon pollution pricing benchmark, consulted July 16, 2021.

- Government of Canada, Environment and natural resources, Weather, climate and hazards, Climate change, Canada’s climate plan, Carbon pollution pricing, How carbon pricing works, consulted July 13, 2021.

- Idem.

- Quebec Department of the Environment and the Fight against Climate Change, Climate Change, Carbon Market, consulted July 13, 2021.

- Idem. Both California and Quebec have a carbon market, and both are auctioning the “right to pollute.” As both states are selling the rights in the same auction, prices in Quebec are influenced by those in California.

- Lucie Jeudy, “Population distribution of Quebec in 2016, by rural/urban type,” Statista, July 6, 2021.

- Hélène Buzzetti, “L’impact sur les consommateurs de la taxe carbone est chiffré,” Le Devoir, May 19, 2017.

- Martijn Brons et al., “A Meta-analysis of the Price Elasticity of Gasoline Demand. A SUR Approach,” Energy Economics, Vol. 30, No. 5, September 2008, pp. 2113-2114.

- Association du Transport Urbain du Québec, home page, consulted June 21, 2021.

- Jeff Marshall and Ray D. Bollman, “Rural and Urban Household Expenditure Patterns for 1996,” Rural and Small Town Canada Analysis Bulletin, Statistics Canada, Vol. 1, No. 4, 1999, p. 4.

- Authors’ calculation. Databank of Official Statistics on Québec, Statistics and publications, Transport, users and infrastructure, Road transportation, Nombre de véhicule en circulation selon le type d’utilisation et le type de véhicule, Québec, région administratives et municipalité de résidence du propriétaire du véhicule, consulted July 15, 2021; Institut de la statistique du Québec, Statistics, By Theme, Demography and population, Population and age structure, Population and age and sex structure – Administrative regions, Detailed Tables, Population estimates for administrative regions, Québec, July 1, 1986 to 2020, consulted July 15, 2021.

- There is a small proportion of motorized vehicles that are not registered in any region (0.42%, or 28,241 of a total 6,697,819). As a result, the calculations are made separately for the regions and the provincial average.

- Quebec Department of the Environment and the Fight against Climate Change, op. cit., endnote 13.

- Idem.

- Using the provincial raw fuel consumption data from Statistics Canada, we divided the 2019 fuel consumption by the population to obtain consumption per capita. We then multiplied this average by the number of motorized vehicles per capita obtained previously (Table 1). This gives us an average fuel consumption per capita (in litres). Multiplying this number by the added cost of the carbon tax on fuel for 2022 (11.63¢ /litre) gives us the added cost due to increased carbon pricing in each region.

- A dissemination area is the smallest standard geographical area for which census data are disseminated and consists of 400-700 people in one or more dissemination blocks (area equivalent to a city block). Statistics Canada, “Dissemination area: Detailed definition,” September 17, 2018.

- Jed Chong and Milanan Simikian, “Shale Gas in Canada: Resource Potential, Current Production and Economic Implication,” Library of Parliament, January 30, 2014, p. 4.

- Authors’ calculations. National Institute of Standards and Technology, Labs & Major Programs, Physical Measurement Laboratory, Divisions, Weights and Measures, Si Units-Volume.

- Reuters, “Quebec seeks fracking moratorium in shale gas rich area,” May 15, 2013.

- Jillian Kestler-D’Amours, “Quebec to ban shale gas fracking, tighten rules for oil and gas drilling,” CBC News, June 6, 2018.

- Petroleum Resources Act, chapter H-4.2, r. 2, Regulation respecting petroleum exploration, production and storage on land, article 197.

- Petroleum Resources Act, chapter H-4.2, r. 1, Regulation respecting petroleum exploration, production and storage in a body of water, article 1.

- Jon Rozhon and Paul Kralovic, An Assessment of the Economic and Competitive Attribute of Oil and Natural Gas Development in Québec, Canadian Energy Research Institute, November 2015, p. 66.

- Ibid., p. 65.

- Merriam-Webster, Dictionary, Man-year, consulted July 16, 2021.

- Government of Canada, Natural Resources Canada, Our Natural Resources, Energy Sources & Distribution, Clean fossil fuels, Natural Gas, Shale and Tight Resources in Canada, Quebec’s Shale and Tight Resources, consulted July 16, 2021.

- Quebec Department of Energy and Natural Resources, Énergie, Hydrocarbures, Portrait des activités au Québec, Exploration en Gaspésie et dans le Bas Saint-Laurent, 2016.

- Authors’ calculations. The average unemployment rate and employment was determined by excluding data from the years 2020 and 2021 due to the effect of the pandemic on the labour force. However, the average unemployment and employment rates in Gaspésie over a five-year period including the years 2020-2021 vary by less than 1%. Government of Québec, Institut de la statistique du Québec, Statistics, by Theme, Employment and labour market, Labour force, employment and unemployment, Labour force, employment and unemployment, administrative regions, CMA, Québec, Monthly data (Labour force, employment and unemployment. Regional statistics), Caractéristiques du marché du travail, données mensuelles désaisonnalisées, régions administratives et ensemble du Québec (in French only), consulted July 16, 2021.

- John Woodside, “Quebec rejects $14B LNG project over environmental concerns,” Canada’s National Observer, July 21, 2021.

- Énergie Saguenay, The Énergie Saguenay project’s development, consulted July 23, 2021.

- Helene Baril, “Le moment de vérité approche,” La Presse, March 23, 2021.

- La Presse Canadienne, ”GNL Québec: le gouvernement va trancher d’ici la fin de l’été,” Les Affaires, April 29, 2021.

- Miguel Ouellette and Olivier Rancourt, “Du gaz naturel québécois pour combattre les changements climatiques,” Le Journal de Montréal, March 23, 2021.

- Miguel Ouellette, “Énergie Saguenay: A Tough Blow for Quebecers,” MEI, July 21, 2021.

- Marla Orenstein, “Opinion: Old wells, new life and a major economic opportunity,” Calgary Herald, April 16, 2020.

- Energy Futures Lab, Initiatives, Initiatives Overview, New Uses for Inactive Wells, consulted July 23, 2021.

- Victoria Goodday and Braeden Larson, The Surface Owner’s Burden: Landowner Rights and Alberta’s Oil and Gas Well Liabilities Crisis, The School of Public Policy Publications, University of Calgary, SPP Research Paper, Volume 14:16, May 2021, p. 2.

- Ibid., p. 11.

- Energy Futures Lab and Canada West Foundation, The LEAD Project Leveraging our Energy Assets for Diversification, March 2021, p. 4.

- Ibid., p. 6.

- Ibid., p. 7.

- Marla Orenstein, “Opinion: Repurposing inactive well sites is Alberta’s ultimate recycling project,” Calgary Herald, April 26, 2021.

- Energy Futures Lab and Canada West Foundation, op. cit., endnote 48, pp. 5, 11.

- Bob Weber, “Abandoned oil and gas wells put unfair burden on Alberta landowners, taxpayers, study says,” CBC News, May 20, 2021.

- Victoria Goodday and Braeden Larson, op. cit., endnote 46, p. 22.

- Paul Haber, “Alberta town on the verge of collapse due to aging oil wells,” CTV News, November 7, 2020.

- Idem.

- Victoria Goodday and Braeden Larson, op. cit., endnote 46, p. 21.

- Idem.

- Barb Glen, “Orphan wells: Alberta’s $47 billion problem,” The Western Producer, March 22, 2018.

- Vanessa Corkal, “Who Will Pay for Alberta’s Orphan Wells?” International Institute for Sustainable Development, March 26, 2020.

- Anthony A. Davis, “Bankrupt oil companies are saddling Albertans with ‘orphan wells’,” Maclean’s, May 2, 2019.

- Government of Canada, op. cit., endnote 4.

- Idem.