Canada’s Welfare Wall: Enhancing the CWB for Full-Time Employment

Economic Note showing that a targeted top-up subsidy and increased frequency of benefit disbursements could address our labour shortages and result in a positive net gain in government revenues

The Canada Workers Benefit—in its current form—fails to incentivize full-time work for low-income Canadians, according to this Economic Note published by the Montreal Economic Institute.

Related Content

Related Content

|

|

|

| Workers Benefit not working for workers (Financial Post, May 4, 2023)

Study shows Canada Workers Benefit fails at getting people off welfare (Western Standard, May 6, 2023) |

This Economic Note was prepared by Jason Dean, Associate Researcher at the MEI and Assistant Professor of Economics at King’s University College at Western Ontario, in collaboration with Renaud Brossard, Senior Director, Communications at the MEI. The MEI’s Taxation Series aims to shine a light on the fiscal policies of governments and to study their effect on economic growth and the standard of living of citizens.

In the midst of unprecedented labour shortages, Canada’s social assistance programs remain burdened with counterproductive incentives that act as stumbling blocks for recipients trying to navigate their way into the workforce. In Quebec, for instance, recipients confront significant financial barriers when considering employment; nearly two-thirds of their benefits evaporate due to tax changes and benefit reductions, leaving a meagre net gain of $4.61 per hour worked.(1) This “welfare wall” intensifies the struggle for employers seeking workers in a job market brimming with opportunities.

The Canada Workers Benefit (CWB) program, intended to inspire work and counteract the disincentives inherent in Canada’s social assistance programs, falls short of dismantling the welfare wall and incentivizing full-time work.(2) As increasing retirements exacerbate Canada’s labour shortage,(3) the need for swift and effective measures is paramount. Encouraging able-bodied recipients to take the plunge into the workforce not only addresses labour shortages, but also boosts government budgets through higher tax revenues and reduced social spending, ultimately driving productivity and economic growth.(4)

A Program That Falls Short of Its Full Potential

The Canada Workers Benefit is a federal subsidy program that supports low-income workers through a refundable tax credit. Modelled after the US Earned Income Tax Credit (EITC), it provides a wage supplement that increases with employment earnings up to a certain threshold, beyond which the subsidy is gradually reduced to zero.(5) This phase-in and phase-out structure is meant to reward employment and facilitate the transition toward self-sufficiency.

As increasing retirements exacerbate Canada’s labour shortage, the need for swift and effective measures is paramount.

The CWB’s rules are largely consistent across most provinces and territories, although Quebec, Alberta, and Nunavut have adapted their programs.(6) Quebec, in particular, has raised its maximum subsidy for unattached singles by over 96% since 2018, resulting in a subsidy that is now roughly 2.3 times higher than in the rest of the country.(7) To be eligible for the CWB, applicants must be over 19, reside in Canada, have employment earnings, and not be full-time students.(8) The Canada Revenue Agency oversees the program and disburses payments based on tax filings.

The CWB’s fundamental approach offers a valuable way to promote employment among able-bodied recipients. Research indicates that the program can enhance labour force participation and income, especially for lone-parent families,(9) echoing the US EITC program’s success.(10)

Nonetheless, the CWB falls short of its full potential. The subsidy amount is typically insufficient to motivate full-time work. Under the 2022 configuration, the subsidy is almost entirely phased out for full-time minimum wage earners. This creates a barrier to pursuing full-time work and achieving self-reliance, and thus to developing long-lasting skills, forging a career path, and reducing dependence on social assistance.

Another challenge concerns the timing of the benefit and awareness of it. Economic theory argues that rewards closely linked to the timing of decisions have a more significant impact on behaviour.(11) The CWB subsidy is detached from the decision to work, as it is paid out only at income tax time. Moreover, combining the subsidy with other tax credits and income sources can make it difficult for taxpayers even to recognize they are receiving the benefit.(12) This undermines the CWB program’s effectiveness.

A related limitation involves the low subsidy amount offered to unattached singles,(13) who comprise approximately 77% of the social assistance caseload.(14) Initially designed to support families with children facing financial hardships, the program provides less assistance for single individuals, the maximum credit being 42% lower and phased out well before earnings associated with full-time work at minimum wage.(15)

Does the CWB Incentivize Work for Singles?

The federal government’s original aim when it introduced the CWB was to “make work pay” by diminishing the welfare wall and enabling low-income workers to retain more of their earnings,(16) thus curbing employment disincentives. A useful way to quantify these disincentives and gauge the CWB program’s impact is by calculating the participation tax rate. This measures the total “cost” of transitioning to employment for individuals on social assistance by capturing the combined effects of tax changes and benefit reductions.(17)

To truly dismantle the welfare wall, the CWB subsidy must meaningfully reduce participation tax rates, making work more appealing. Yet estimates for full-time workers at the minimum wage, with and without the CWB subsidy, show that it has little effect. Ontario and Quebec, together accounting for nearly 70% of total recipients, serve as illustrative examples. In these provinces, the CWB does practically nothing to encourage full-time work, with participation tax rates dropping by a meagre one percentage point in the presence of the subsidy—from 57% to 56% in Quebec, and from 44% to 43% in Ontario—hardly enough to tear down the welfare wall.(18)

The CWB does practically nothing to encourage full-time work, with participation tax rates dropping by a meagre one percentage point in the presence of the subsidy.

This lack of impact is primarily due to the subsidy benefit being phased out for those working full-time at minimum wage throughout the year. Despite the staggering $1.2-billion price tag for singles in 2019,(19) overcoming the welfare wall remains an uphill battle for recipients, even with the CWB’s support. A refined CWB design focusing on full-time worker support could enhance the program’s alignment with its original objectives. Conveniently, the existing program can be tweaked without having to enact new legislation.

An Improved CWB Credit: Targeted and More Frequent

Two significant modifications would enhance the impact of the CWB: a targeted top-up subsidy for full-time employment and increased frequency of benefit disbursements. These changes would better promote full-time work among unattached singles, who are not currently receiving adequate support from the program.

The proposed top-up subsidy would be a lump-sum credit, not phased in, and provided only to inactive welfare recipients and existing part-time CWB recipients who transition to full-time work. The amount of the subsidy is based on findings from the Canadian Self-Sufficiency Project, a government initiative that provided earnings supplements to long-term income assistance recipients by offering monthly cash payments contingent on securing and maintaining full-time employment.(20) As earnings increase, the top-up would be phased out more quickly than the current system in order to mitigate costs while still offering a powerful incentive for low-income earners. Those who do not secure full-time work would continue to receive the existing subsidy with its phase-in/phase-out scheme.(21)

With its more targeted approach, the proposed top-up subsidy would be more cost-effective because no additional payments must be made to existing claimants who remain part-time or to those already working full-time. This also avoids the potential risk of some individuals reducing their work hours just to become eligible for the subsidy. Furthermore, most full-time workers are likely motivated to maintain their current employment due to factors such as job security, benefits, and career advancement opportunities.

The second proposed change aims to strengthen the connection between rewards and work behaviour by increasing the frequency of CWB payments, which should be deposited at least bi-weekly. Introducing more frequent payments should not impose a significant burden, as the Canada Revenue Agency’s existing system is already capable of processing monthly payments for programs like the Canada Child Benefit and the GST/HST credit. The federal government recently acknowledged the need for timelier payments, and plans to implement automatic quarterly advance payments starting in 2023.(22) However, this still leaves a three-month disconnect between the work decision and its reward. Leveraging the existing direct deposit system to make more frequent payments should not impose a significant increase in administrative costs. The positive impact of more prompt payments on incentivizing work is expected to outweigh any related costs.

Top-Up Subsidy’s Impact on Full-Time Participation and Government Budgets

The focused approach of the top-up subsidy can actually enhance government budgets, as the additional amount spent on the top-up subsidy is more than offset by lower social assistance spending and more income taxes collected from those now working full-time. Drawing on insights provided by the Self-Sufficiency Project, Ontario is used here as a case study to assess the impact of the proposed top-up subsidy on full-time work participation and on government budgets. The Project provided a generous earnings supplement of roughly 20% to long-term income assistance recipients, promoting self-sufficiency and reducing welfare dependency.(23) Notably, the program yielded net savings to the government through increased income tax revenues and decreased welfare payments, making it a relevant model for the proposed top-up subsidy.

The reduction in social assistance payments, combined with income tax increases, more than offsets costs, resulting in a net gain of nearly $120 million.

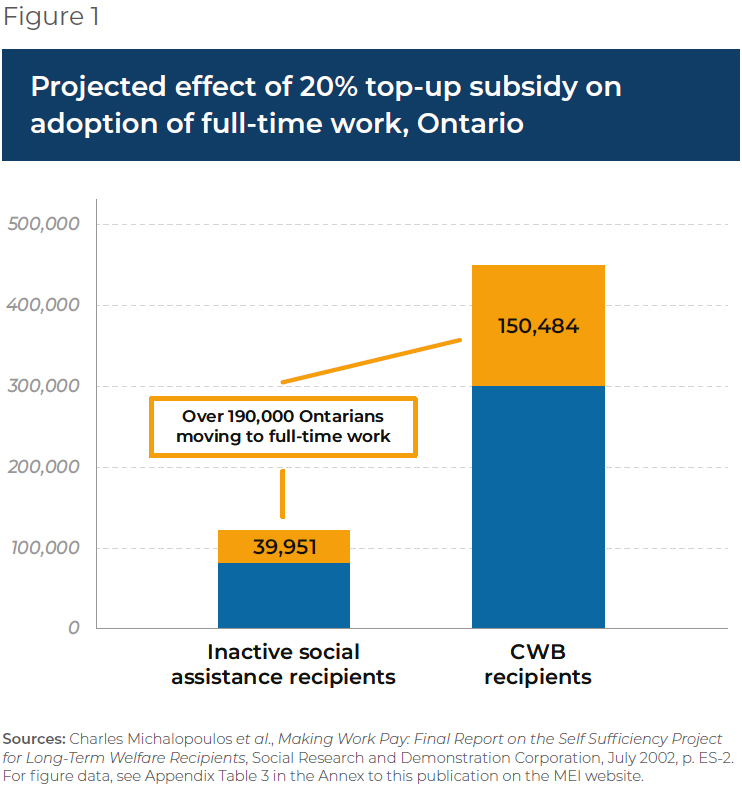

Figure 1 estimates the uptake of the top-up subsidy, which affects two groups: inactive welfare recipients and existing CWB recipients. One-third of the long-term recipients offered the Self-Sufficiency Project supplement took up the offer and worked full-time. Applying this uptake rate to inactive and current CWB claimants would incentivize 39,951 Ontario Works recipients and 150,484 CWB claimants to work full-time.

The necessary top-up subsidy to achieve this uptake in Ontario is $3,545, corresponding to a 20% increase in the net financial gain for full-time work, as per the Self-Sufficiency Project study. Figure 2 shows the proposed subsidy’s impact on government budgets. The total cost of providing the subsidy is estimated to be $546.4 million, with social assistance recipients receiving $141.6 million and existing CWB recipients receiving $404.7 million. However, the reduction in social assistance payments of $395.1 million, combined with income tax increases of $271.2 million, more than offsets these costs, resulting in a net gain of nearly $120 million.(24) This is a prudent estimate, as it does not factor in the impact of higher incomes on sales taxes, payroll taxes, and other potential spillover effects.

Conclusion

The current Canada Workers Benefit configuration, set to cost a staggering $4 billion in 2023,(25) barely makes a dent in reducing participation tax rates, and so does virtually nothing to encourage full-time employment. Its current design is penny-wise, saving money by offering inadequate incentives, but pound-foolish, as it misses out on the more-than-offsetting increase in income taxes and reduction in social assistance benefits that would result from significantly incentivizing full-time work. Thus, taxpayers’ money is squandered for only a minimal effect on reducing barriers for social assistance recipients.

Introducing a targeted top-up subsidy for full-time employment and implementing more frequent disbursements of benefits can effectively address the shortcomings of the CWB program—and result in a positive net gain in government revenues. Given Canada’s persistent labour shortages and its aging population, not to mention the sorry state of federal public finances, there is an urgent need for policy-makers to reassess the program and give these recommended reforms serious consideration.

References

- Jason Dean and Celia Pinto Moreira, “Labour Shortages: Helping a Trapped Pool of Potential Workers Help Themselves,” MEI, February 2023, p. 3; Celia Pinto Moreira, “The inactivity trap: Would you leave welfare for $4.61/hr?” Financial Post, February 15, 2023.

- Department of Finance Canada, The Economic and Fiscal Update: Background Material to the Presentation, November 2005, p. 129; Canada Revenue Agency, Income Statistics and GST/HST Statistics, Canada Workers Benefit Statistics – 2019 Tax Year, December 29, 2022.

- Statistics Canada, “In the midst of high job vacancies and historically low unemployment, Canada faces record retirements from an aging labour force: number of seniors aged 65 and older grows six times faster than children 0‑14,” The Daily, April 27, 2022.

- Tegan Hill, Alex Whalen, and Milagros Palacios, “An Aging Population: The Demographic Drag on Canada’s Labour Market,” Fraser Institute, August 2022, p. 5.

- For further details on the structure of the CWB and the subsidy amounts, see Appendix 1 in the Annex to this publication on the MEI’s website. Dwayne Benjamin et al., Labour Market Economics 9th Edition, McGraw Hill Canada, 2021, p. 89.

- The Canada Workers Benefit (CWB) can be reconfigured by provinces and territories with respect to the basic amount and disability supplement. See Mohy Tabbara, “What is the Canada Workers Benefit, and how could it be better?” Maytree, October 2021, pp. 12-13.

- TaxTips.ca, Working Income Tax Benefit (WITB) Factors for 2018 for Quebec, November 28, 2021; TaxTips.ca, Canada Workers Benefit (CWB) Factors for 2022 for Quebec, January 28, 2023; TaxTips.ca, Canada Workers Benefit (CWB) Factors for 2022 Except Quebec, January 28, 2023.

- Government of Canada, Canada workers benefit – Eligibility, December 9, 2022.

- Nail Annabi, Youssef Boudribila, and Simon Harvey, “Labour supply and income distribution effects of the working income tax benefit: a general equilibrium microsimulation analysis,” IZA Journal of Labour Policy, Vol. 2, No. 19, 2013, p. 21.

- Austin Nichols and Jesse Rothstein, “The Earned Income Tax Credit,” in Economics of Means-Tested Transfer Programs in the United States, Volume 1, University of Chicago Press, 2016, p. 204; Hilary Hoynes, “The Earned Income Tax Credit,” The Annals of the American Academy of Political and Social Science, Vol. 686, November 2019, p. 198.

- Ted O’Donoghue and Matthew Rabin, “Doing it now or later,” The American Economic Review, Vol. 89, No. 1, 1999, pp. 118-120; Ide Bagus Siaputra, “Temporal motivation theory: Best theory (yet) to explain procrastination,” Anima Indonesian Psychological Journal, Vol. 25, No. 3, 2010, p. 208

- Mohy Tabbara, op. cit., endnote 6, p. 22.

- Kevin Milligan, “FINA Testimony: Canada Workers Benefit,” April 30, 2018.

- In Ontario and Quebec. Jason Dean and Celia Pinto Moreira, op. cit., endnote 1, p. 2.

- TaxTips.ca, Canada Workers Benefit (CWB) Factors for 2022 Except Quebec, January 28, 2023.

- Department of Finance Canada, Budget 2007, March 19, 2007, p. 144.

- Charlotte Bartels, Long-term Participation Tax Rates, SOEPpapers on Multidisciplinary Panel Data Research, DIW Berlin, November 2013, pp. 1-4.

- Author’s calculations based on data for 2020-2021. See Appendix Tables 1 and 2 for details. Mohy Tabbara, Social Assistance Summaries, 2021, Maytree, July 2022, pp. 64 and 84.

- Canada Revenue Agency, Table 3: Number of CWB recipients and the amount credited by Family Status, 2019, consulted March 27, 2023.

- Charles Michalopoulos et al., Making Work Pay: Final Report on the Self Sufficiency Project for Long-Term Welfare Recipients, Social Research and Demonstration Corporation, July 2002, p. 1.

- See Appendix Figure 2 for a comparison of the proposed top-up and the current scheme.

- Department of Finance Canada, Fall Economic Statement 2022, 2022, p. 23.

- Charles Michalopoulos et al., op. cit., endnote 20, p. ES-2.

- The following studies find that the costs of boosting the subsidy amount are either quite low or nearly revenue neutral, largely due to the offsetting increases in income taxes and reduction in social assistance payments. However, these studies do not specifically consider a targeted top-up subsidy for full-time work, which is more budget-friendly because it does not raise the subsidy for existing claimants who remain in part-time work or for those already in full-time employment. Gillian Petit and Jonathan Rhys Kesselman, “Reforms to earnings supplement programs in British Columbia: Making work pay for low-income workers,” SSRN, December 2020; Jacob E. Bastian and Maggie R. Jones, “Do EITC expansions pay for themselves? Effects on tax revenue and government transfers,” Journal of Public Economics, Vol. 196, April 2021.

- Bill Curry, “Ottawa’s $4-billion boost to workers benefit to go mostly to Canadians no longer eligible, PBO says,” The Globe and Mail, November 15, 2022.