Federal Government Deficits and Debt: Should We Be Worried?

Economic Note situating federal public finances in a historical context and evaluating the gravity of the situation by defining the risks associated with the government’s growing debt

The federal government’s gross debt has increased by 50% since the start of the Trudeau government’s first mandate, shows an Economic Note published by the Montreal Economic Institute.

Related Content

Related Content

|

|

|

| Congratulations! Ottawa has you $50,000 in debt (Western Standard, April 18, 2023)

Canada Is on ‘Race Toward Financial Shipwreck’: Report (The Epoch Times, April 19, 2023) Federal government must act in light of debt increase: MEI (The Suburban, April 26, 2023) |

This Economic Note was prepared by Nathalie Elgrably-Lévy, Senior Economist at the MEI, in collaboration with Renaud Brossard, Senior Director, Communications at the MEI. The MEI’s Taxation Series aims to shine a light on the fiscal policies of governments and to study their effect on economic growth and the standard of living of citizens.

In April 2015, Justin Trudeau said that if voters put their trust in him, he would balance the budget as of the very first year of his term.(1) But in December of that year, the newly minted prime minister had backtracked and was now giving himself four years to return to a balanced budget.(2) Since then, the federal government has regularly made headlines because of its extraordinary propensity to spend, its annual failures to eradicate the deficit, and the explosive growth of the debt.

According to the baseline scenario presented in the 2022 Fall Economic Statement, Finance Minister Chrystia Freeland was projecting a slight surplus in 2028, five years from now.(3) Even though such numbers may have seemed to bode well, Yves Giroux, the Parliamentary Budget Officer, was already worried that Ottawa meant to use its new room to manoeuvre to fund $52.2 billion of new spending by 2028.(4)

However, all hope of a return to a balanced budget evaporated with the budget tabled by Ms. Freeland on March 28, 2023. Due to new commitments, deficits for the next four years will be considerably higher than projected, and for 2028, the deficit will hit $14 billion instead of the $4.5‑billion surplus announced last November.(5)

All hope of a return to a balanced budget evaporated with the budget tabled by Ms. Freeland on March 28, 2023.

With so many jostling figures, and given the growth of the debt from successive deficits, can Canadians really feel reassured given the state of the federal government’s finances, or should they instead be worried about the government’s current trajectory and its level of debt?

The Debt Reaches an All-Time High in 2022

The federal government’s debt attracts attention especially due to its rapid growth.(6) Sometimes the gross debt is mentioned, sometimes the net debt. The gross debt corresponds to the government’s total liabilities. It is the sum of all the deficits accumulated since Confederation, to which are added pension plan and future welfare liabilities. The net debt corresponds to the gross debt less the federal government’s financial assets.

Although the government can in theory sell its financial assets to repay its liabilities, we prefer to focus our analysis on the gross debt, notably because many assets have relatively low liquidity, or their market value is difficult to evaluate, which makes them of little use as potential sources of funding. Note also that the two measures of the debt follow very similar trajectories over the long term.

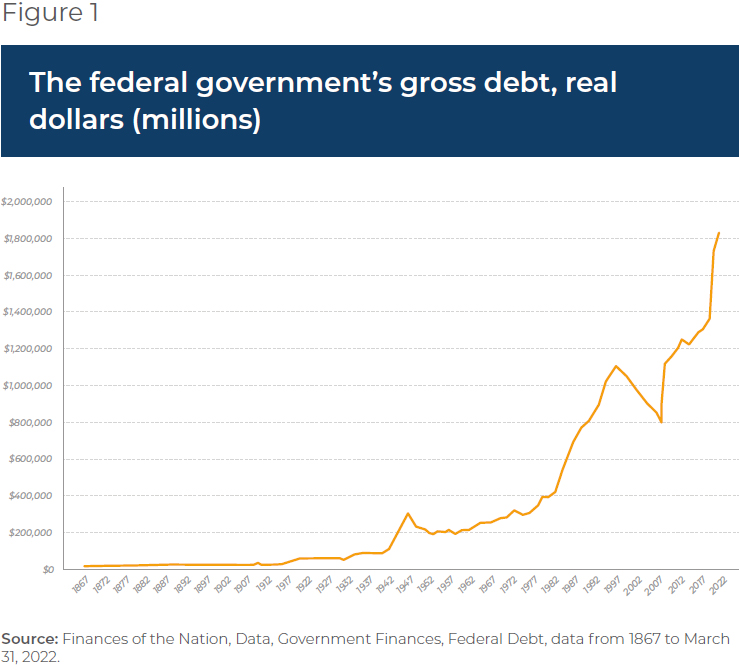

Figure 1 presents the evolution of the debt since 1867, adjusted for inflation. We can see that for the period as a whole, the debt has been trending upward. It notably increased substantially starting in 1981 due to the accumulation of deficits resulting from the rapid growth of government spending. The debt hit a peak in 1998, coming back down thereafter.

This turnaround was abruptly interrupted, however, by the 2008 financial crisis. Between 2008 and 2014, the gross debt increased by 55%.(7) And in 2015, with the election of Justin Trudeau’s government, the debt resumed its rise and increased by 50% to reach an all-time high in 2022.(8) What is surprising, however, about the recent surge of the debt is that it began before the start of the pandemic and is occurring while Canada is neither at war nor in a recession and does not have to quell a financial crisis.

Today, the federal government welcomes each newborn by attributing them a debt of $47,179.

Given that the population increases as the years go by, the debt is shouldered by a continually growing number of taxpayers. It therefore merits being expressed also as a function of the population. Figure 2 illustrates the evolution of the gross debt per capita, adjusted for inflation. It is clear that the debt grew more rapidly than the population, since the ratio follows an upward trajectory. As for the main trends, they are similar to those of the gross debt. In this case, the gross debt per capita increased by 34.1% since 2019.(9) Today, the federal government welcomes each newborn by attributing them a debt of $47,179.

Evolution of Revenues, Expenditures, and the Deficit

While the pandemic was an exceptional occurrence that could justify certain extraordinary expenditures, and thus an unusual increase in the level of indebtedness, it cannot explain the rapid deterioration of federal public finances since the Trudeau government’s first term. Note that after having registered deficits following the 2008 crisis, Ottawa had managed to balance its budget in 2014.(10)

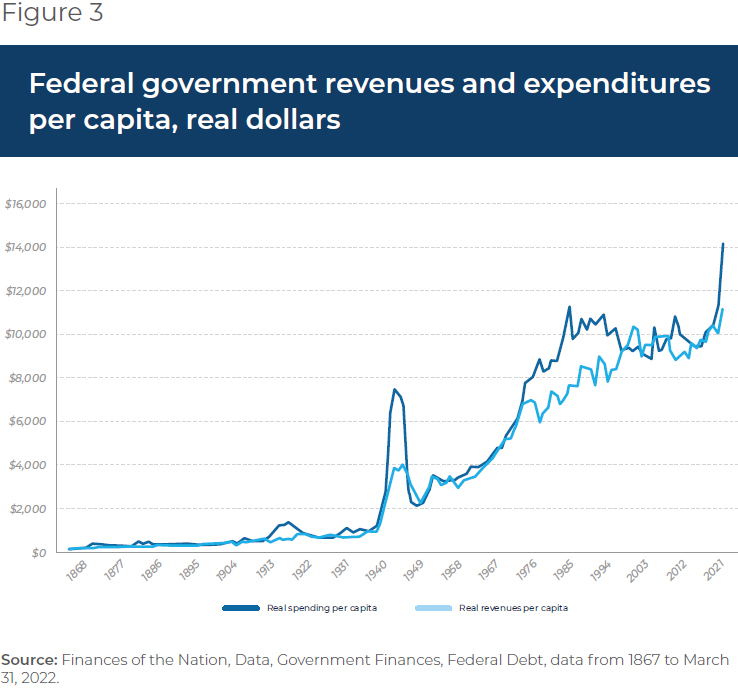

Figure 3 shows that revenues and expenditures, expressed per capita and in real terms, have reached all-time highs not registered in times of war nor in times of economic crisis.

Between 2015 and 2019, real expenditures per capita increased by 12.6%, versus 10.3% for revenues, which explains the accumulation of deficits and the growth of the debt. Canada had therefore returned to deficits well before the start of the health crisis. The deficit was reduced between April and November 2022, but according to the latest budget, it will be $43 billion for the 2022-2023 fiscal year(11) (versus $36.4 billion projected in the November 2022 economic update).(12) This deficit is larger than the budgets of the Departments of Transport, Health, Industry, Public Safety, Justice, Public Works, Natural Resources, the Environment, and Agriculture, and the RCMP, combined.(13) It works out to a deficit of around $173 million per business day, or over $21 million per hour in the workday.(14)

Debt Has Consequences

Situating public finances in a historical context is essential for appreciating their recent evolution, but it is insufficient for evaluating the gravity of the situation. It is also important to define the risks associated with growing debt, because although these multi-billion-dollar figures may seem abstract, even when broken down per person, the consequences of budgetary carelessness are numerous, serious, and very real. Without going into technical details, here are a few that are widely accepted in the economic literature:

- As the federal debt increases, debt service payments also increase, which reduces the funds available for other budget items like those devoted to assisting vulnerable people.

- The slowdown of economic growth is certainly one of the most serious effects of indebtedness, as investors purchase government bonds rather than making productive investments in the private sector (crowding out effect). As a result, the productivity growth of labour slows, and in turn, the growth of living standards.(15)

- Debt financing exerts upward pressure on interest rates. Rising rates then impact the rest of the economy through higher borrowing costs across the board.(16)

- Substantial debt and large deficits when an economy is neither in wartime nor in crisis limits the budgetary room to manoeuvre that the government could need in a recession or emergency situation.(17)

- The debt has a considerable effect on intergenerational equity. A baby born in Canada today inherits a debt and will have to bear its economic consequences, mentioned above.

Do We Need to Worry about the Federal Debt?

In light of the above observations and given the plethora of undesirable consequences resulting from public indebtedness, the answer to the question posed at the start of this Note, “Should we worry about the federal government’s indebtedness?” is yes.

Yes, because not only has the federal debt reached an all-time high, but the lack of budgetary rigour both in the fall 2022 economic update and in the March 2023 budget seems to indicate a denial of reality. While the economic conditions that prevailed in the fall could have allowed for sounder public finances, the Finance Department had decided to announce new spending. It did so again this past March, with the spectre of recession looming ever closer.

But worrying does not mean despairing.

In the early 1990s, after several decades of deficits, a constantly growing debt, and debt service payments that ate up around a third of tax revenues, Canada was flirting with financial catastrophe. Indeed, the gravity of the situation forced Standard & Poor’s to lower the Canadian government’s credit rating from AAA to AA+ in October 1992.(18) Moody’s then proceeded to downgrade Canada in April 1994 and again in April 1995.(19) Also, in January 1995, a Wall Street Journal editorial(20) described Canada as “an honorary member of the Third World in the unmanageability of its debt problem.” The Canadian dollar was thus nicknamed the “northern peso.”(21)

Not only has the federal debt reached an all-time high, but the lack of budgetary rigour seems to indicate a denial of reality.

This editorial having had the effect of a sledgehammer on Canada, the Liberal government of Jean Chrétien adopted an audacious budget(22) in February 1995 aiming to rapidly get public finances back in order.

This budget was a turning point in government finances, with Ottawa undertaking a series of reforms (including of employment insurance) leading to the biggest reduction in public spending since the demobilization that followed the Second World War. There was also a very modest increase in taxes and a historic shrinking of the size of government, with 45,000 civil servant positions being eliminated.(23)

These efforts led to a budgetary “rebirth”: as of 1998, the country ran a surplus, its first in 27 years.(24) Economic miracles are therefore possible.

Act Now

Canada is on a slippery slope once again. Thankfully, it is not too late to stop the race toward financial shipwreck. But there is little time to waste, for as this wise apocryphal saying often attributed to American President John Adams(25) rightly points out, “There are two ways to conquer and enslave a country. One is by the sword. The other is by debt.”

To succeed the way Jean Chrétien did, Ottawa must start by acknowledging the gravity of the situation, and then not just slow the growth of spending but quickly proceed with a significant reduction in the size of government. If pragmatic, effective measures are not taken today, we will surely face more painful decisions tomorrow.

References

- The Canadian Press, “Justin Trudeau promises to balance federal budget, scrap TFSA increase,” Toronto Star, April 22, 2015.

- The Canadian Press, “Justin Trudeau says vow to balance budget in 4 years is ‘very’ cast in stone,” CBC, December 17, 2015.

- Department of Finance Canada, Publications and Reports, Fiscal Updates, Fall Economic Statement 2022, Annex 1: Details of Economic and Fiscal Projections, November 3, 2022.

- Jason Jacques et al., Fall Economic Statement 2022 — Issues for Parliamentarians, Office of the Parliamentary Budget Officer, November 15, 2022, p. 1.

- Department of Finance Canada, Publications and Reports, Federal Budget, Budget 2023, Annex 1: Details of Economic and Fiscal Projections, March 28, 2023.

- Mylène Crête, “La dette coûtera plus cher,” La Presse, December 14, 2021.

- Author’s calculations. Finances of the Nation, Data, Government Finances, Federal Debt, data from 1867 to March 31, 2022.

- Idem.

- Idem.

- Government of Canada, The Road to Balance: Creating Jobs and Opportunities, February 11, 2014, p. 268.

- Department of Finance Canada, op. cit., endnote 5.

- Department of Finance Canada, op. cit., endnote 3.

- Government of Canada, About government, Government-wide reporting on spending and operations, Planned government spending, Government Expenditure Plan and Main Estimates (Parts I and II), 2022-23 Estimates, last modified July 12, 2022.

- Based on 1,992 work hours per year.

- Congressional Budget Office, “The Economic Effects of Waiting to Stabilize Federal Debt,” April 28, 2022, p. 15; Michael Falkenheim, The Welfare Effects of Debt: Crowding Out and Risk Shifting, Congressional Budget Office, December 16, 2022, p. 15.

- Jonathan Huntley, The Long-Run Effects of Federal Budget Deficits on National Saving and Private Domestic Investment, Congressional Budget Office, February 28, 2014, p. 1; Edward Gamber and John Seliski, The Effect of Government Debt on Interest Rates, Congressional Budget Office, March 14, 2019, p. 1.

- Christina D. Romer and David H. Romer, Fiscal Space and the Aftermath of Financial Crises: How It Matters and Why, National Bureau of Economic Research, April 2019, pp. 2-4.

- United Press International, “S&P downgrades Canada foreign currency debt,” October 14, 1992.

- Heather Scoffield, “Canada regains triple-A credit rating,” The Globe and Mail, May 4, 2002.

- The Wall Street Journal, “Bankrupt Canada?” January 12, 1995.

- DeNeen L. Brown, “Canada’s ‘Loonie’ Heading South,” Washington Post, February 1st, 2002; Randall Palmer and Louise Egan, “Insight: Lessons for U.S. from Canada’s ‘basket case’ moment,” Reuters, November 22, 2011; Chris Edward, “We Can Cut Government: Canada Did,” CATO Institute, Policy Report, May-June 2012.

- Government of Canada, Budget 1995, February 1995, p. 2.

- Idem.

- Government of Canada, The Budget Plan 1999: Including Supplementary Information and Notices of Ways and Means Motions, February 16, 1999, p. 45.

- John Adams Historical Society, Quotes, consulted April 4, 2023.