Are Electric Vehicle Subsidies Efficient?

Ontario and Quebec have set ambitious targets aimed at reducing greenhouse gases (GHGs), respectively 37% and 37.5% by 2030 compared to 1990 levels. The transportation sector is crucial for achieving these ambitious targets, since it represents over a third of the emissions of each province. These have therefore decided to implement, among other things, subsidies to electric vehicles. But is this injection of public funds the best use of our money?

Media release: Electric vehicle subsidies: expensive and ineffective

Related Content

Related Content

|

|

|

| Le gaspillage des subventions aux voitures électriques (La Presse+, June 22, 2017)

Electric-vehicle subsidies (Toronto Sun, June 25, 2017) |

Interview (in French) with Germain Belzile (Québec aujourd’hui, BLVD 102.1 FM, June 22, 2017)

Interview (in French) with Germain Belzile (Isabelle, CHMP-FM, June 26, 2017) |

Interview with Germain Belzile (On the Money, CBC-TV, June 22, 2017)

Interview (in French) with Germain Belzile (Mario Dumont, LCN-TV, June 22, 2017) |

Are Electric Vehicle Subsidies Efficient?

Ontario and Quebec have set ambitious targets aimed at reducing greenhouse gases (GHGs), respectively 37% and 37.5% by 2030 compared to 1990 levels.(1) The transportation sector is crucial for achieving these ambitious targets, since it represents over a third of the emissions of each province.(2) These have therefore decided to implement, among other things, subsidies to electric vehicles. But is this injection of public funds the best use of our money?

In Ontario, incentives aimed at increasing the number of electric vehicles on the road include a subsidy for the purchase of a new electric or rechargeable hybrid vehicle of up to $14,000,(3) as well as a 50% rebate on the purchase and installation of a charging station for the home representing some $750.(4) The Ontario plan also includes investments of $80 million to deploy public charging stations across the province.(5)

Quebec has put similar measures in place: a subsidy for the purchase of a new electric or rechargeable hybrid vehicle of up to $8,000, and a rebate of up to $600 for the purchase and installation of a home charging station. Subsidies for the installation of public and corporate charging stations are also planned.(6) Quebec has also announced the implementation of a quota system for 2018 imposing targets on manufacturers for sales of “zero emission” vehicles. Manufacturers will also be able to buy credits from others who are in surplus situations.(7) Those who do not meet the government’s targets will have to pay a fine.

The Footprint of an Electric Vehicle

Four factors influence the environmental impact of using an electric vehicle.(8) First, the greater the fuel consumption of the vehicle replaced, the bigger the positive impact. The principle is the same for annual mileage: The greater the distance travelled in a year in an electric car instead of a conventional car, the greater the reduction in GHG emissions. Third, we must take into account the emissions related to the electricity used to recharge the battery.

And finally, the environmental record of an electric vehicle must also be calculated over its entire lifecycle, including its manufacture. The latter produces on average 7.5 tonnes of GHGs, compared to 6.5 tonnes of GHGs for a traditional automobile.(9)

In all, the manufacture and operation of a gasoline-powered vehicle adds, over the course of a useful life of 10 years, 37.4 tonnes of GHGs to the atmosphere.(10) In Quebec, where electricity is produced almost entirely from hydropower, a fully electric vehicle will emit a total of 7.5 tonnes of GHGs (entirely associated with the manufacture of the car), versus 9.2 tonnes of GHGs for the same vehicle in Ontario, where electricity is not as “clean.”(11) The net emissions avoided by the use of a rechargeable electric car is therefore 28.2 tonnes of GHGs in Ontario, and 29.9 tonnes of GHGs in Quebec.

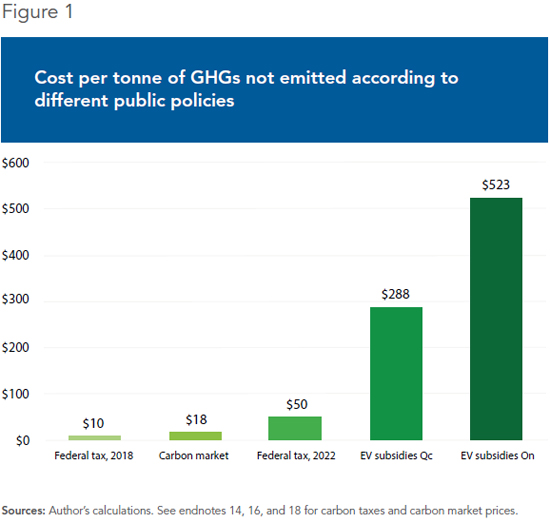

How Much Does It Cost to Avoid One Tonne of GHGs?

As noted above, the total cost for taxpayers for a typical electric vehicle sold in Ontario, including the purchase subsidy and the subsidy for the charging station, is $14,750. For the same vehicle sold in Quebec, the total subsidy is $8,600.

It is easy to calculate the cost of each tonne of GHGs not emitted thanks to these provincial programs by dividing the cost of the subsidy by the quantity of emissions avoided. We thus arrive at a total of $523 per tonne in Ontario and $288 per tonne in Quebec. These are prudent estimates. The cost per tonne of GHGs not emitted thanks to the subsidies is likely higher, for a number of reasons.

First, a certain number of buyers of electric vehicles would have made their purchases even in the absence of subsidies. One study estimates that this is the case for half of buyers in Quebec.(12) The proportion is likely much higher for most subsidies paid to buyers of luxury vehicles. All subsidies that are applied to a purchase that would have been made anyway have no effect on GHG emissions and are a pure loss.

Second, although the incentive measures aimed at increasing the purchase of electric vehicles can no doubt increase the number of them on the road, interactions between these measures and other environmental policies will likely cancel out, at least in part, the net effects on GHG emissions. For example, Canada and the United States already have common GHG emissions standards per vehicle, the CAFE standards (Corporate Average Fuel Economy).

This regulation sets an annual reduction target for average emissions. Given that electric vehicles reduce average emissions, manufacturers are in fact subject to less demanding standards for their non-electric vehicles. Concretely, each time a manufacturer sells an electric vehicle, the obligation to reduce the fuel consumption of one of its gasoline-powered models is lessened.(13)

For these reasons, our estimates of the government’s cost of $288 per tonne of GHGs not emitted in Quebec, and $523 per tonne in Ontario, is probably well below the actual cost. It is nonetheless very high when compared with other ways of reducing GHG emissions, as we shall see.

The Least Expensive Way to Reduce GHGs

Insofar as the reduction of GHGs is becoming a priority, the innovation that emerges naturally thanks to supply and demand remains the preferable path. If our legislators nonetheless think that additional incentives are required, tools like a tax on emissions or a carbon market create less distortion in the economy and are less expensive than providing generous subsidies to the purchase of electric vehicles.

A carbon market already exists in North America. It groups together California, Quebec, and soon Ontario. On this market, the price per tonne of GHGs was C$18.51 in the most recent auction, in May 2017.(14) Ontario, which will join the carbon market in 2018,(15) held its first, solo auction in March 2017, with the sale price of an allowance being $18.08 per tonne of GHGs.(16)

This amount represents the marginal cost of eliminating one tonne of GHGs.(17) A company with emission levels exceeding its allowance—in other words, its “right” to emit—thus has two options: It can either reduce its emissions so as to respect its obligations, or it can purchase additional emissions allowances on the carbon market from companies that have surplus allowances.

The principle is similar when it comes to the federal tax for those provinces that will not have established a price for carbon, which will come into effect in 2018. The tax rate will then be set at $10 per tonne, climbing to $50 per tonne in 2022.(18) Companies that can reduce their emissions at a cost that is lower than the tax rate have an incentive to do so.

We can therefore compare the costs at which the federal government’s carbon tax, the carbon market, and provincial subsidies achieve the same goal. Each tonne of GHGs avoided will cost from $10 to $50 in the first case, around $18 in the second, $288 for electric vehicle subsidies in Quebec, and $523 for those in Ontario (see Figure 1).

By subsidizing the purchase of electric cars, the Ontario government is paying 29 times more than the carbon market price per tonne of GHGs eliminated, and 52 times more than the future federal tax when it comes into effect next year. For Quebec, the corresponding figures are 16 and 29 times more. Even if we take the maximum amount of the carbon tax, namely $50 in 2022, electric vehicle subsidies remain the most expensive option by far.

Impact on Public Finances and on Emissions

The Quebec government set a target of 100,000 electric or rechargeable hybrid vehicles on the road by 2020, and 1,000,000 by 2030.(19) Public spending on these vehicles could therefore reach from $460 million to $860 million by 2020, and from $4.6 billion to $8.6 billion by 2030.(20) Once again, this scenario is very prudent, since it supposes that none of these cars will be replaced over the course of 13 years.

The Ontario government, for its part, instead set an annual sales target for electric vehicles, namely 5% of total sales in 2020, which represents government spending of from $980 million to $1.7 billion, and from $4.9 billion to $8.6 billion if projected to 2030.(21)

The inefficiency of the Quebec and Ontario programs can be illustrated in two other ways. The first is to calculate the appropriate amount of the subsidy, based on the number of tonnes of GHGs eliminated per electric vehicle and the price per tonne, as determined by the carbon market. At $18 per tonne of GHGs, the subsidy amount should not exceed $550, both in Quebec and in Ontario. Even using the level of the federal tax in 2022, at $50 per tonne, the subsidy should not exceed $1,500.(22)

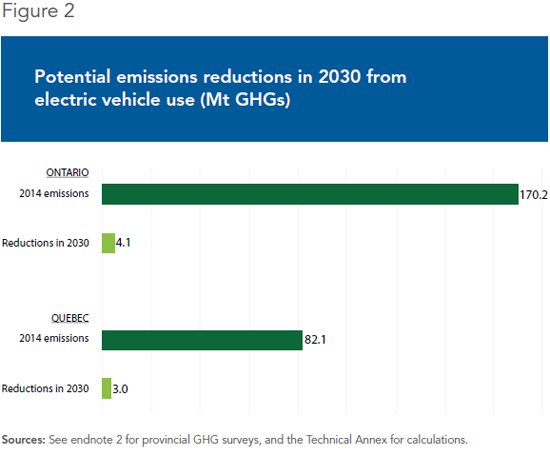

The second alternative way of illustrating the inefficiency of these programs is to evaluate the portion of current GHG emissions that would be eliminated thanks to the replacement of gasoline-powered vehicles by electric vehicles. The latest survey produced by Quebec estimated that 82.1 million tonnes of GHGs were emitted in 2014 throughout the province.(23) Even if the government achieved its goal of having a million electric vehicles on the road by 2030 (and assuming these were all fully electric), in the best case scenario, only 3 million tonnes of GHGs would be avoided annually, or 3.6% of current emissions. Ontario, for its part, emitted 170.2 million tonnes of GHGs in 2014.(24) Even if Ontario’s fleet of electric vehicles reached the same size, proportionally, as Quebec is aiming for in 2030—a much more demanding scenario than their actual plan—Ontario could not hope to eliminate more than 4.1 million tonnes of GHGs per year, or 2.4% of current emissions (see Figure 2).(25)

Conclusion

Subsidies for the purchase of electric vehicles have little effect on GHG emissions and are much more expensive than other incentive measures that achieve the same results. Between different methods that produce the same results, the more expensive method should never be favoured. If the goal is to obtain the greatest emissions reductions for the amounts spent, then subsidies for the purchase of electric vehicles are actually the least efficient, most expensive way to get there. The Quebec and Ontario governments should abolish them.

This Economic Note was prepared by Germain Belzile, Senior Associate Researcher at the MEI, and Mark Milke, independent policy analyst. The MEI’s Environment Series aims to explore the economic aspects of policies designed to protect the natural world in order to encourage the most cost-effective responses to our environmental challenges.

References

1. Government of Ontario, Ontario’s Climate Change Strategy, November 2015, p. 9; Government of Quebec, Ministère du Développement durable, de l’Environnement et de la Lutte contre les changements climatiques (MDDELCC), Engagements du Québec : Nos cibles de réduction d’émissions de GES.

2. Environmental Commissioner of Ontario, “Ontario’s Carbon Footprint – Where Are We Now? (Chapter 2),” in Annual GHG Progress Report – Facing Climate Change, November 2016, p. 39; Government of Quebec, MDDELCC, Inventaire québécois des émissions de gaz à effet de serre en 2014 et leur évolution depuis 1990, 2016, p. 7.

3. Although the amount of the subsidy varies by model, most electric vehicles sold in Ontario are eligible for the maximum subsidy of $14,000. Vehicles selling for more than $150,000 are not eligible for subsidies. Government of Ontario, Ministry of Transportation, Electric vehicle charging incentive program.

4. As the Ontario government has not produced an evaluation of the cost of a charging station, we based our figure on the Quebec government’s estimate for a level 2 station, namely $1,500 on average for purchase and installation, applying the Ontario subsidy. Government of Quebec, Transportation Electrification Action Plan, Charging, At home.

5. The Kathleen Wynne government has also announced its intention to negotiate with the federal government the elimination of the 13% harmonized sales tax on new and used electric vehicles. Government of Ontario, Ministry of the Environment and Climate Change, “Making the Switch: Electric Vehicle Advantages,” Press release, June 8, 2016.

6. Vehicles selling for $75,000 or more are eligible for a maximum subsidy of $3,000. Those selling for over $125,000 are not eligible to any subsidy. Frédéric Mercier, “Québec coupe dans les subventions pour les voitures électriques haut de gamme,” Le Journal de Montréal, March 29, 2017; Government of Quebec, Transportation Electrification Action Plan, Purchase or Lease Rebate Program; Government of Quebec, Transportation Electrification Action Plan, Charging Station Rebate (Individuals); Government of Quebec, Transportation Electrification Action Plan, Charging Station Rebate (Businesses, Municipalities, Organizations).

7. Quebec National Assembly, “An Act to increase the number of zero-emission motor vehicles in Québec in order to reduce greenhouse gas and other pollutant emissions,” ratified October 26, 2016. The Environment Minister estimated in parliamentary committee that this program would bring in $17 million in 2018. Pierre Couture, “Quotas de vente de véhicules électriques: des concessionnaires automobiles nerveux,” Le Journal de Montréal, June 8, 2017.

8. For the purposes of this part of the analysis, we focused on the impact of subsidies to electric vehicles, which have more of an impact than hybrids in terms of emission reductions.

9. The production of an electric vehicle emits between 15% and 86% more GHGs than the production of a traditional vehicle, depending on size and performance. We decided to use the low end of this range for our calculation. Rachael Nealer, David Reichmuth, and Don Anair, Cleaner Cars from Cradle to Grave, Union of Concerned Scientists, November 2015, p. 21; Linda Ager-Wick Ellingsen, Bhawna Singh, and Anders Hammer Strømman, “The Size and Range Effect: Lifecycle Greenhouse Gas Emissions of Electric Vehicles,” Environmental Research Letters, No. 11, 2016, p. 4.

10. Youri Chassin and Guillaume Tremblay, “Do We Need to Subsidize the Purchase of Electric Cars?” Economic Note, MEI, November 27, 2014.

11. The calculation follows the methodology used in the Economic Note “Do We Need to Subsidize the Purchase of Electric Cars?” (op. cit., endnote 10). It takes into account GHG emissions during the production of electricity, in the case of Ontario.

12. Xavier Mercier, Paul Lanoie, and Justin Leroux, “Costs and Benefits of the ‘Quebec Purchase/Lease Rebate Program for Cleaner Vehicles’,” HEC Montréal, September 2014, p. 11.

13. Ian Irvine, “Electric Vehicle Subsidies in the Era of Attribute-Based Regulations,” Canadian Public Policy, Vol. 43, No. 1, March 2017.

14. Government of Quebec, MDDELCC, “Vente aux enchères conjointe no 11 de mai 2017 – Rapport sommaire des résultats,” May 24, 2017, pp. 3-4.

15. Government of Ontario, Ministry of the Environment and Climate Change, “Ontario, Quebec and California Hold Joint Climate Meeting in Marrakech,” Press release, November 16, 2016.

16. Government of Ontario, Ministry of the Environment and Climate Change, “Ontario Announces Results of First Cap and Trade Program Auction,” Press release, April 3, 2017.

17. No firm will pay more to purchase an emissions allowance than its own cost for eliminating the emissions in question. In the case of the Quebec-California market, given that the equilibrium price is equal to the price floor established by the authorities, we can surmise that the true marginal cost of eliminating one tonne of GHGs is less than $18.51.

18. Agence QMI, “Taxe carbone : 10 $ la tonne dès 2018, 50 $ en 2022,” Le Journal de Montréal, October 3, 2016.

19. Association des véhicules électriques du Québec, “Croissance des véhicules électriques requise pour l’atteinte des objectifs du gouvernement du Québec,” April 10, 2016.

20. Most plug-in hybrid vehicles receive $4,000 in subsidies, plus the subsidy for the charging station. Government of Quebec, Véhicules électriques – Eligible Vehicles and Rebate Amount.

21. See the Technical Annex to this Economic Note on the website of the MEI for detailed calculations.

22. Ibid.

23. Government of Quebec, op. cit., endnote 2, p. 17.

24. Environmental Commissioner of Ontario, op. cit., endnote 2, p. 39.

25. See the Technical Annex for detailed calculations for Quebec and Ontario.