Viewpoint – Should Small Business Investments Be Permitted in a TFSA?

Created in 2009, Tax-Free Savings Accounts (TFSAs) provide a flexible savings option. But TFSA rules forget about small businesses, shows an MEI Viewpoint published today suggesting that the category of qualified investments be expanded. Large corporations are already well-served by various investment vehicles; it is now time to think of small companies as well. Tax-Free Savings Accounts are the perfect tool for this.

Media release: TFSAs: It’s time to think of small businesses

Related Content

Related Content

|

|

|

|

Changing TSFA rules will help small business (Montreal Gazette, February 9, 2017)

Les manœuvres comptables s’appliqueraient-elles au CELI? (The MEI's Journal de Montréal blog, February 9, 2017) CELI : aider Jean à encourager Brigitte (La Presse+, February 10, 2017) |

Interview (in French) with Youri Chassin (Le Tour d'Horizon, 92,7FM-Ottawa, February 13, 2017) |

Viewpoint – Should Small Business Investments Be Permitted in a TFSA?

Created in 2009, Tax-Free Savings Accounts (TFSAs) provide a flexible savings option. Unlike Registered Retirement Savings Plans (RRSPs), contributions to a TFSA are not deductible for income tax purposes, but withdrawals are tax-free, including for investment income earned in the account. TFSAs can therefore be used to save money in anticipation of a major purchase or a trip, or in case of unforeseen events, in addition to investing money for retirement, and withdrawn at one's discretion with no penalty.

Tax-Free Savings Accounts are used by nearly 12 million Canadians as savings vehicles, including 1.8 million who attain the maximum contribution limit. These accounts contain $151.6 billion, or an average of nearly $13,000 per contributor.(1) People with modest or average incomes seem particularly inclined to use a TFSA as a savings vehicle.(2)

An Advantage for Big Businesses

The flexibility that is characteristic of TFSAs does not extend to the kinds of investments that are permitted, however. These are the same ones as for RRSPs: basically, mutual funds, shares listed on a stock exchange, bonds, and guaranteed investment certificates.(3)

The Income Tax Act in its current form makes practically no provision for investing in start-ups and companies in development using TFSAs or RRSPs.(4) Small businesses, rarely listed on stock exchanges, are thus at a disadvantage. For example, an investor cannot finance the business of a friend or loved one through a TFSA, which means that any earnings would be taxable. The savings of Canadians thus in fact finance big businesses listed on stock exchanges.

Yet small businesses with fewer than 100 employees account for a significant share of economic activity. Despite their small size, they are so numerous—over 1.1 million in Canada, or 98% of existing businesses—that they account for 70% of all jobs in the private sector.(5)

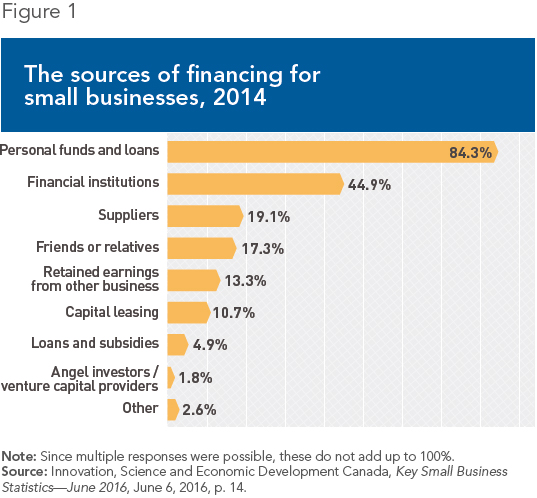

Access to funding is one of the main hurdles facing small businesses. They have more difficulty than larger businesses when it comes to obtaining funds from financial institutions, and they pay higher interest rates on the loans they do get.(6) Furthermore, 84.3% of the heads of start-up enterprises rely on personal financing, namely their own funds or personal loans, but relatively few of them (17.3%) receive financing from friends or relatives. Ironically, they are more likely to obtain credit from their suppliers (19.1%) than from their loved ones (see Figure 1).

A Simple Change to Income Tax Rules

Modifying the rules that govern TFSAs by allowing Canadians to invest in small businesses instead of restricting them to large ones would not only expand their savings options, but also improve the access that small businesses have to private funding. This solution would stimulate the start-up and growth of businesses financed by the savings of loved ones, of a community, or of small investors using their TFSAs for this purpose.

This type of investment through a TFSA could easily be permitted by modifying article 204 of the Income Tax Act, “qualified investment,” in order to include shares of small businesses.(7) This modification of qualified investments for TFSAs poses no particular challenge. Such investments would enjoy the same regulatory protections as in the case of an ordinary investment not made through a TFSA.

The measure of the fair market value of the assets for tax purposes is not a problem either, since the purchase and sale prices of a small business share has no fiscal impact for a TFSA, whose returns are tax-free.(8) It is therefore not necessary to precisely measure the fair market value of shares for purposes of tax compliance.

In exceptional cases in which this kind of calculation is necessary, it would be possible to follow the same guidelines applied for a family business transfer.(9) In this case as in the case of small businesses, the market value of the company is not determined by financial transactions on the stock market, but this in no way prevents equity investments. The rules established in situations in which companies are transferred to a member of the next generation could serve as a default method.(10)

Finally, for governments, the admissibility of small business investments would entail no additional costs. This change would affect only the list of qualified investments without modifying contribution limits. It is also highly unlikely that this minor modification would entail any appreciable rise in the level of TFSA savings.

On the other hand, many investors could then benefit from this provision to finance promising projects. If the results were compelling in the case of TFSAs, then qualified investments for RRSPs could also be similarly modified.(11)

In 1979, the Quebec government had set up another savings vehicle, the Stock Savings Plan, which led to the creation of several of today’s large Quebec businesses.(12) Similarly, opening up TFSAs to investments in small businesses not listed on a stock exchange could constitute a minor revolution in the development of a culture of savings in support of entrepreneurship.

This Viewpoint was prepared by Youri Chassin, Economist and Research Director at the Montreal Economic Institute. The MEI’s Taxation Series aims to shine a light on the fiscal policies of governments and to study their effect on economic growth and the standard of living of citizens.

References

1. Canada Revenue Agency, Tax-Free Savings Account statistics (2014 tax year), Table 1: TFSA holders, and Table 3: TFSA Fair Market Value, Contributions and Withdrawals, October 13, 2016.

2. “CELI : près de 20 % des cotisants ont atteint le maximum,” Conseiller, May 11, 2015.

3. Canada Revenue Agency, Individuals and families, TFSA, Types of investments, November 24, 2016.

4. Government of Canada, Income Tax Act, last amended January 2017.

5. The data are from December 2015. Innovation, Science and Economic Development Canada, Key Small Business Statistics—June 2016, June 6, 2016, pp. 1 and 6.

6. Queenie Wong, “SME Financing Indicators,” Canadian Federation of Independent Business, October 2016, pp. 5 and 7.

7. Subsection 207.01(1), which defines “qualified investment” in the case of TFSAs, refers to the definition from Section 204. The other option is to specifically modify Subsection 207.01(1).

8. It is interesting to note that even in the case of an RRSP, earned profits and returns have no fiscal impact as long as the funds are not withdrawn, at which point the amounts withdrawn testify to the fair market value of the investment.

9. Government of Canada, op. cit., endnote 4, Sections 69 and 84.1.

10. See for example Pascal Leclerc, “Transmission d’entreprises—Aspect fiscal—Analyse de l’article 84.1 L.I.R.,” Presented in the context of continuing education at the Association de planification fiscale et financière, October 2016; Luc Martel, La transmission de l’entreprise : aspect fiscal I, Presented in the context of the 23rd conference of the Association de planification fiscale et financière, 1999.

11. Government of Canada, op. cit., endnote 4, Subsection 146(1). This article defines “qualified investment” in the case of RRSPs.

12. Bilan du siècle, Création du Régime d’épargne-actions, March 27, 1979. Companies such as CGI, Saputo, Transat A.T., Cascades, Couche-Tard, Jean Coutu, Héroux-Devtek, and Transcontinental are among those that benefited from the Stock Savings Plan. See Jean-Paul Gagné, “Le programme de REA se meurt. Qui se préoccupe de sa relance?” Les Affaires, December 13, 2014.