The “Forgotten” Keynes on Government Spending, Inflation, and Price Controls

Economic Note showing that Keynes himself warned against the dangers of the Keynesian policies that have been resurrected by politicians in recent years

Famed British economist John Maynard Keynes would have disagreed with the Bank of Canada’s policy of purchasing government bonds with newly-minted cash, according to this joint study published by the Montreal Economic Institute and the Morocco-based Arab Center for Research.

Related Content

Related Content

|

|

|

| What would economist John Maynard Keynes think of Canada’s high inflation? (Toronto Star, June 25, 2023) |

This Economic Note was prepared by Mohamed Moutii, Associate Researcher at the MEI, in collaboration with Daniel Dufort, President and CEO of the MEI.

Governments’ reactions to the global COVID-19 pandemic dealt a severe blow to the world economy, leading to the biggest economic downturn since the Great Depression.(1) In response, commentators(2) worldwide have resurrected the well-worn ideas of John Maynard Keynes (so-called Keynesianism), debating how much money governments should spend to counter the possibility of a recession, and which means central banks should employ to support them.

The economic theory of Keynesianism, spelled out in his famous book The General Theory of Employment, Interest and Money (1936),(3) is commonly understood as advocating for government intervention in the economy through policies such as deficit spending and reduced interest rates. The theory recommends that in times of economic downturn or crisis, the government should increase its spending to boost demand and stimulate economic growth. According to Keynesianism, and in contradiction to Say’s law, demand generates its own supply, and hence an upsurge in demand will trigger an increase in supply, eventually leading to economic growth.

However, in other lesser-known works, Keynes articulated economic views that actually directly contradict Keynesianism. For example, in his earlier essays, The Economic Consequences of the Peace (1919)(4) and Am I a Liberal? (1925)(5), he explained how markets were self-regulating, and how government deficits could, in fact, cause more harm than good. He argued that the government’s responsibility should be mainly restricted to preserving economic stability by avoiding inflation and maintaining a stable currency. This is the “forgotten” Keynes in today’s public debate and among policy-makers.

In the current inflationary period, it is useful to reread him, especially on inflation and the price controls proposed to contain it. Surprisingly, he actually warned against the dangers of the very Keynesian policies that have been resurrected by politicians worldwide in recent years.

The Current Inflationary Environment

Contrary to popular belief, price inflation does not have multiple and complex causes; rather, it is simply the outcome of excessive money printing.(6) Price inflation arises due to the expansion of the money supply, which governments and central banks often expand under different pretexts such as the COVID-19 pandemic, and then struggle to control. The need to finance budget deficits is the most common justification for printing extra money.

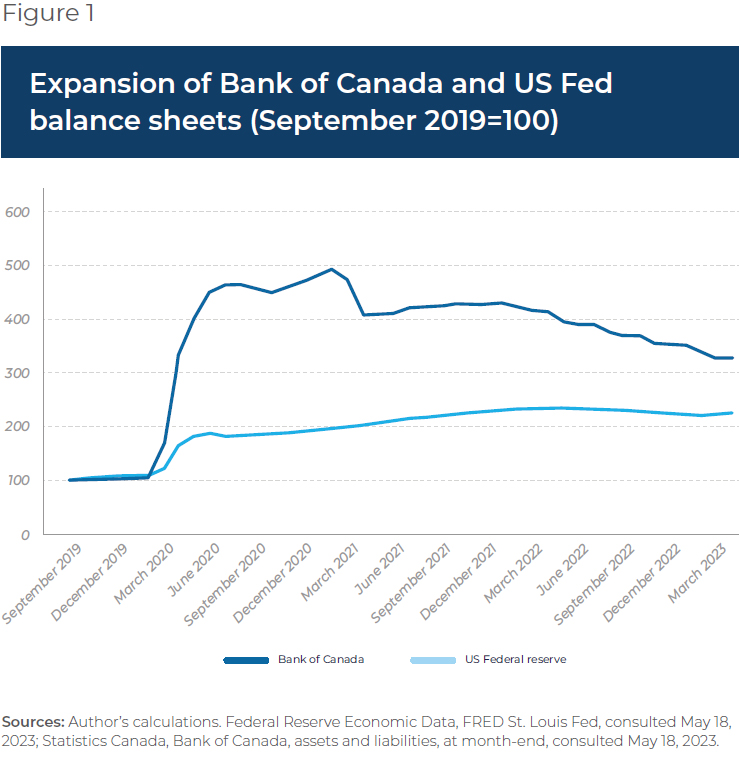

To combat the economic impact of the pandemic and related restrictions, governments worldwide have engaged in significant money printing and fiscal stimulus, as can be seen in the expansion of their balance sheets. For instance, the Federal Reserve’s balance sheet more than doubled in the wake of COVID-19 (see Figure 1), surging to over $9 trillion in early 2022 from about $4 trillion prior to the pandemic.

A similar trend can be observed in the expansion of the Bank of Canada’s balance sheet, which has undergone a substantial transformation, almost quintupling from $122 billion in February 2020 to $576 billion in February 2021. It is still $382 billion as of April 2023, more than three times its pre-pandemic level. This is the most substantial increase in the Bank of Canada’s assets since the Second World War, and it occurred remarkably quickly.(7) Interestingly, the relative increase in the Bank of Canada’s balance sheet is substantially higher than that of the US Federal Reserve, and remains at a relatively higher level compared to the pre-pandemic level in 2019.

These expansions of the money supply have led to higher rates of price inflation, triggering anxiety among policy-makers and the general public in countries around the world, including Canada and the US. Rereading Keynes on money printing as the cause of price inflation would certainly have been useful.

Keynes on Price Inflation

What would the “forgotten” Keynes have said about these recent events? One of the key policies that Keynes was critical of in his early writings was precisely the printing of money. Contrary to the popularized version of Keynesianism, Keynes argued that printing money would result in price inflation, which would in turn lead to economic instability.

Moreover, according to Keynes, maintaining a stable currency was essential for achieving economic growth and social stability. Governments should therefore exercise caution when issuing new currency, and avoid measures that might cause inflation.

In The Economic Consequences of the Peace, Keynes demonstrated a keen understanding of the relationship between government deficits and inflation. He explicitly pointed out that government printing money to cover deficits was synonymous with inflation:

The inflationism of the currency systems of Europe has proceeded to extraordinary lengths. The various belligerent Governments, unable, or too timid or too short-sighted to secure from loans or taxes the resources they required, have printed notes for the balance.(8)

But such debasement of the currency reduces the purchasing power of money, causing prices to increase and living standards to decline. It negatively affects people with fixed incomes, savers, and those holding cash or cash-equivalent assets as their value diminishes.

Moreover, inflationary policies, such as expanding the money supply, can create an artificial boom by stimulating consumption and investment. However, this boom is unsustainable as it is not based on an increase in real savings and productive capacity. Consequently, resources are misallocated into sectors that appear profitable due to artificial demand but may not be sustainable in the long run. When the inflationary policies cease, a bust follows, leading to economic downturns and wasted resources, a malinvestment process which Austrian-school economists like Hayek and Mises have emphasized,(9) but which Keynes unfortunately did not go far enough to foresee.

Nevertheless, Keynes understood that inflation amounts to a hidden government confiscation, and redistribution, of people’s purchasing power, creating in the process economic and social mayhem. He specifically pointed out 104 years ago that

[b]y a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they also confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. […] There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.(10)

Price Controls Doing More Harm Than Good

Price controls are a measure that regularly comes back into the public debate when prices soar, as politicians succeed in convincing the general public that inflation is the fault, not of irresponsible governments and central banks, but of greedy business owners.(11)

For example, in the current inflationary context, politicians in the US introduced a new bill(12) last year, seeking to limit the ability of companies to raise prices on consumer goods and services during crises. The bill proposes that corporations should face financial penalties if they raise prices beyond the extent of their increased production costs.(13)

However, those attracted by the idea of price controls would gain important insights by rereading Keynes, who clearly understood that implementing price controls to fight inflation is ineffective. He specifically opposed wage and price controls, stressing all the damages they would cause, as summed up in the following passage from The Economic Consequences of the Peace:

The presumption of a spurious value for the currency, by the force of law expressed in the regulation of prices, contains in itself […] the seeds of final economic decay, and soon dries up the sources of ultimate supply.(14)

In fact, interestingly, even wars were not enough to justify price controls according to Keynes. Thus, during World War II, he opposed price controls, believing that freely fluctuating prices were critical to the functioning of the economy.

Price controls are indeed ineffective at stopping or slowing down inflation and can, as experience has shown multiple times, cause more harm than good.(15) For instance, in reaction to sharp spikes in oil prices in the 1970s, the American government imposed price caps on gasoline. The result was immediate shortages. The regulated prices prevented domestic oil companies from proactively boosting or maintaining production, which was essential in order to mitigate interruptions in oil supply from the Middle East.(16)

These price controls squeeze or eliminate profit margins, disrupt production, and predictably lead to shortages. Government price and wage controls, or even monitoring, are merely attempts by politicians to shift the blame for inflation onto producers and sellers instead of taking responsibility for their ill-advised monetary policies.

Today’s politicians should reread Keynes before thinking of imposing price controls, in any shape or form, under the pretext of combatting the price inflation that they caused in the first place.

Conclusion

The COVID crisis has reignited politicians’ appetite for government spending and money printing, in the same vein as the Keynesian policies of the last century, causing a surge in prices. To combat this inflation, policy proposals amounting to price controls in one form or another have multiplied.

By rereading and re-examining the economic theories of Keynes, particularly his early writings on inflation, government spending, and price controls, politicians and policy-makers can gain a better understanding of the risks associated with their current policies and explore potential solutions that may have been overlooked in his work.

The “forgotten” views of Keynes on the importance of maintaining a stable currency for economic prosperity deserve to be rediscovered, and this is a topic that needs to be put in the centre of the public debate. They remain relevant today as governments grapple with the challenges of managing their economies in a rapidly changing inflationary landscape.

References

- During 2020, global GDP fell by 3.4%. By comparison, between 1929 and 1932, it fell by an estimated 15%, and less than 1% from 2008 to 2009 during the Great Recession. Statista, Global real Gross Domestic Product (GDP) growth after the coronavirus (COVID-19) from 2019 with a forecast until 2024, January 3, 2023; Roger Lowenstein, “History Repeating,” The Wall Street Journal, January 14, 2015.

- Munir Quddus, “The Legacy of Keynes in the Age of the Coronavirus Pandemic,” Prairie View A&M University, April 6, 2020.

- John Maynard Keynes, The General Theory of Employment, Interest and Money, Palgrave Macmillan, 1936.

- John Maynard Keynes, The Economic Consequences of the Peace, London: Macmillan & Co., Limited, 1919.

- John Maynard Keynes, Am I a Liberal? Cambridge University Press, 2012 (1925).

- Henry Hazlitt, “Inflation in One Page,” The Freeman, May 1978.

- Sonja Chen and Trevor Tombe, “The Bank of Canada’s millions in balance-sheet losses are only the beginning,” The Globe and Mail, January 12, 2023.

- John Maynard Keynes, op. cit., endnote 4, p. 279.

- Larry J. Sechrest, “Explaining Malinvestment and Overinvestment,” Mises Institute, June 21, 2021.

- John Maynard Keynes, op. cit., endnote 4, pp. 235-36.

- Henry Hazlitt, op. cit., endnote 6.

- Elizabeth Warren, Tammy Baldwin, and Jan Schakowsky, Price Gouging Prevention Act of 2022, US Senate, May 12, 2022.

- Robert Reich, “Corporate greed, not wages, is behind inflation. It’s time for price controls,” The Guardian, September 25, 2022.

- John Maynard Keynes, op. cit., endnote 4, p. 279

- Ludwig Von Mises, “How Price Control Leads to….. Socialism,” Foundation for Economic Education (FEE), June 1st, 1966.

- David R. Henderson, “Price Controls: Still A Bad Idea,” Hoover Institution, January 20, 2022.