The Capital Gains Tax and Inflation: How to Favour Investment and Prosperity

Economic Note demonstrating the importance of taking inflation into account in the calculation of the capital gains tax, especially in our current inflationary context

The inflation rate in Canada has been rising constantly for several months now. Expansionary monetary policies, as well as the economic sanctions accompanying the Russia-Ukraine war, suggest that significant inflation may be with us for the medium to long term. High inflation erodes consumers’ purchasing power, and also has a negative impact on Canadian taxpayers—including through the capital gains tax, an issue the MEI’s researchers examined in this publication.

Related Content

Related Content

|

|

|

| Avec l’inflation galopante, les gains en capital seront encore plus surtaxés (Les Affaires, April 14, 2022)

How to keep inflation and taxes from devouring capital gains (The Globe and Mail, April 18, 2022) With high inflation, capital gains are overtaxed even more (Financial Post, April 20, 2022) |

This Economic Note was prepared by Valentin Petkantchin, Senior Fellow at the MEI, and Olivier Rancourt, Economist at the MEI. The MEI’s Taxation Series aims to shine a light on the fiscal policies of governments and to study their effect on economic growth and the standard of living of citizens.

The Canadian economy is currently experiencing a substantial rise in inflation, with prices 5.7% higher in February 2022 than they were a year earlier, a level not seen since the early 1990s.(1) Expansionary monetary policy, as well as the economic sanctions accompanying the Russia-Ukraine war, suggest that significant inflation is here for a while.

High inflation not only erodes consumers’ purchasing power due to the depreciation of the currency, but it also gives rise to fiscal distortions that affect Canadian taxpayers, notably with regard to the capital gains tax.(2) Taking inflation into account in the calculation of this tax—a proposal that is hardly new(3)—makes sense economically, as it favours investment and prosperity. It is also increasingly indispensable in our current inflationary context if Canada is to remain fiscally attractive.

The issue of capital gains taxation is complex. Its ramifications are many, and include among others its impact on angel investors, entrepreneurship, and more generally the mobility of capital to finance innovation in the economy. This publication aims simply to show the impact of inflation on capital gains and the necessity of taking it into account in taxing them. Future publications will examine other aspects of this tax such as double taxation, and its economic consequences.

Taxing Capital Gains in Canada

Canada had no capital gains tax until 1972, when it adopted this measure following the recommendation of the report of the Royal Commission on Taxation, also known as the Carter Commission (1962-1966).(4)

The taxation of the gain happens when the capital is liquidated (sale or death).(5) Only a portion of the gain is then considered (called the taxable gain), after the application of an inclusion rate—which is currently 50%(6)—to the nominal gain. The taxable gain is then added to the taxpayer’s income, to be taxed in their annual tax return at their marginal rate.(7)

The federal capital gains tax rate is between 0% and 27.56% depending on the taxpayer’s tax bracket.(8) To this must be added provincial taxation, which varies from one province to another. For a Quebecer, for example, the maximum tax rate (federal and provincial) is currently 53.31% (namely 27.56% for the federal level + 25.75% for Quebec).

Thus, for a gain of $2,000, only half, or $1,000, must be declared and is taxable. A taxpayer in the highest tax bracket would therefore pay $533 of tax (53.31% of $1,000).(9)

There are several exemptions, which is to say amounts or goods that are not subject to the capital gains tax. The best known of these is for one’s primary residence, which excludes capital gains when it is sold.(10)

Among the other kinds of exemptions, there is the one for the sale of qualified farm or fishing property (QFFP), which excludes the first $1,000,000 in capital gains.(11) Similarly, there is an exemption for qualified small business corporation shares (QSBCS), of up to $892,218 in 2021.(12)

Overvalued Gains and Taxes Due to Inflation

The realization of capital gains happens over time, and often over the long or very long term. Indeed, 10, 20, or even 40 years may elapse between the purchase of capital and its sale, when any capital gain is realized and, if applicable, taxes are collected.

Due to the cumulative impact of inflation over the years and the resulting depreciation of the currency, the acquisition cost (or purchase price) of the capital should be adjusted upward. Without such an adjustment, as is the case currently in Canada, taxable gains are systematically overvalued compared to real gains, which actually reflect the taxpayer’s enrichment.

Consider an asset bought for $10,000 and sold two years later, with an annual inflation rate of 5%. It needs to be sold for at least $11,025, just to compensate for the effect of inflation. If it is sold for less than this, the taxpayer has actually incurred a loss, due to the depreciation of the currency, even if he realized a nominal gain. Yet Canadian tax agencies will collect tax on this fictional “gain,” making matters worse still.

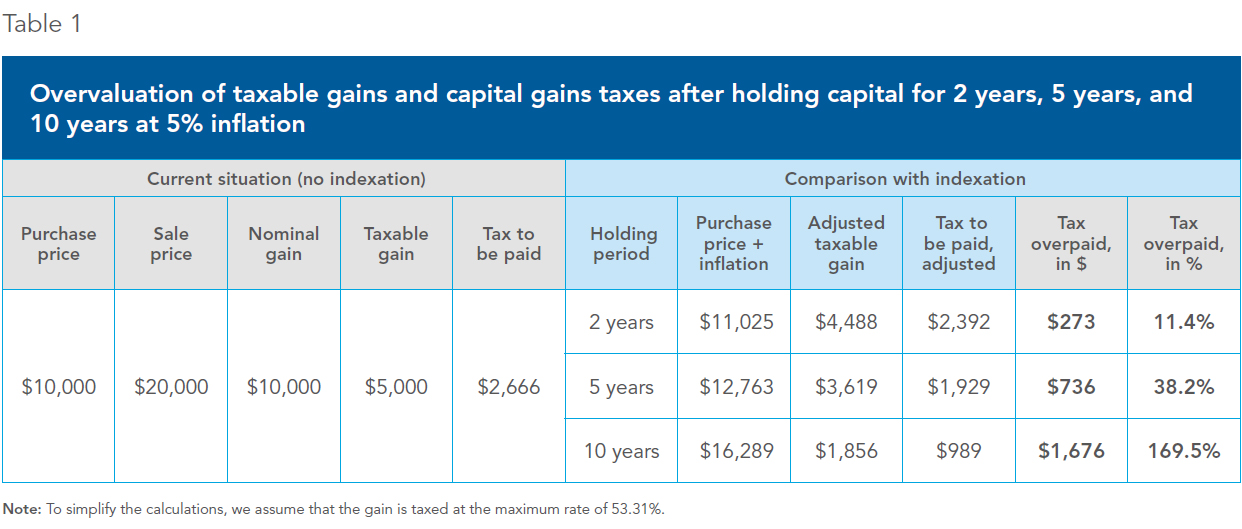

Taxing the nominal gain and not indexing the purchase price from $10,000 to $11,025 thus amounts to taxing an illusory gain. For purposes of illustration, if the above asset ends up being sold for $20,000, the nominal gain will be $10,000 (the sale price of $20,000 less the unadjusted purchase price of $10,000); the real gain, however, will be $8,975 (the sale price of $20,000 less the adjusted purchase price of $11,025). Without adjusting for inflation, the gain would thus be overvalued by $1,025, or around 11% in this case, a non-negligible discrepancy.

The longer the asset is held, the more substantial this overvaluation of the capital gain compared to the real gain, and the greater the share of illusory gains taxed by the government (see Table 1).

After 5 years, for example, the taxable gain and the tax to be paid would thus be almost 40% higher than the real gain and the tax that should have been paid. After 10 years, these would be 170% higher than they should have been, with $2,666 of taxes paid in the current system, 2.7 times the $989 that should have been paid if inflation had been taken into account.

In order to avoid taxing illusory gains, capital gains thus need to be adjusted for inflation. This is all the more indispensable given that the current rate of increase of the CPI reached, 5.7% in February on an annualized basis, a historically high level that is considerably outside the Bank of Canada’s target range of 1% to 3%.(13)

Several solutions exist in practice to adjust the purchase price for inflation.(14) It can be indexed to the CPI (as Israel does—see below) or using the GDP deflator (as an American bill proposes—see below as well).

The Need to Take Inflation into Account If the Inclusion Rate Is Increased

Increasing the capital gains inclusion rate is a theme that recurs regularly in the public debate.(15) If the government ever decided to increase the inclusion rate, for example to 75% or 100%, taking inflation into account would be even more indispensable in order not to penalize entrepreneurs and their investment projects, notably over the very long term.

Historically, the inclusion rate has in fact already been modified on several occasions, from 50% initially in 1972 to 66.67% in 1988, to 75% in 1990, and to 66.67% in February 2000, to finally return to its current level of 50% in October 2000. The goal of reducing the inclusion rate had been precisely to stimulate innovation and facilitate access to capital for Canadian companies.(16) Increasing this rate again would be particularly harmful for taxpayers and entrepreneurs.

The example in Box 1 of the sale of capital after a holding period of 40 years provides a better understanding of the impact of such an increase in the inclusion rate, which is amplified by inflation, even when the policy rate remains relatively low (2.8% on average).

Box 1

Impacts of the inclusion rate and inflation on capital gains taxation

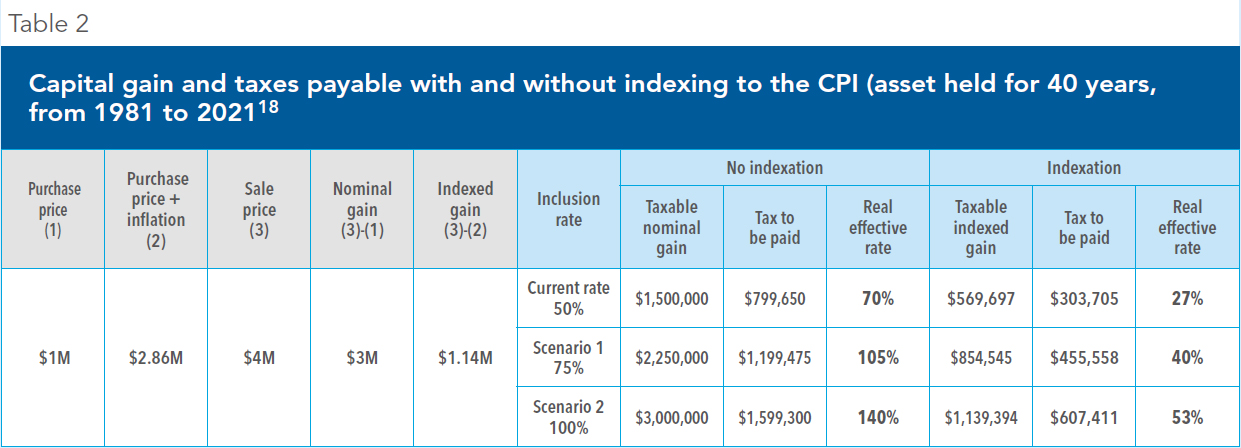

A young entrepreneur buys a company for $1 million in 1981, runs it, and then resells it upon retirement 40 years later, in 2021, for $4 million.(17) The CPI during this time has been multiplied by nearly 2.9, for an average annual increase over the period of around 2.8%, or less than half of the current rate of 5.7%.

The nominal capital gain realized upon the sale of the company’s shares is thus $3 million (the sale price of $4 million less the acquisition cost of $1 million). The real gain, adjusted for inflation, amounts to around $1.14 million (see Table 2).

Current situation with a 50% inclusion rate (with and without indexation)

The taxable gain is $1.5 million and the tax to be paid is $799,650. The real effective tax rate, after adjusting for inflation (the inflation that is not taken into account by the taxman), is over 70% ($799,650/$1,139,394),(19) which is higher than the top combined federal and provincial tax rate (53.31%).

In contrast, if we adjust the purchase price for inflation, the tax to be paid is $303,705 and the effective rate falls to 27%, which keeps Canada fiscally competitive.

Scenario 1: Inclusion rate of 75% (with and without indexation)

With such an increase in the inclusion rate, and in the absence of other changes to the tax system, the tax payable would be $1.2 million, which is greater than the real capital gain itself ($1.14 million), and the real effective tax rate would be a particularly high 105%. Such a tax would be confiscatory, in fact impoverishing the taxpayer: Even though, on paper, a nominal gain of $3 million was realized, once the tax on this is paid, the taxpayer is poorer than without this “gain.”

If indexed for inflation, the tax to be paid would still be $455,558, the real effective rate coming back down to 40%.

Scenario 2: Full inclusion of capital gains (with and without indexation)

The tax payable climbs to nearly $1.6 million, an amount that is far greater than the real capital gain itself, for a real effective rate of over 140%. Such a tax would be highly confiscatory.

In contrast, with indexation, the real effective tax rate falls back down to 53.31%, the top combined federal and provincial rate.

For a Canadian Economy That’s More Attractive Internationally

Taking inflation into account is important not just for taxpayers, but also for the attractiveness of the Canadian economy for international investment. Certain countries, such as Israel, have put in place different methods of taking inflation into account in taxing capital gains.(20) Other countries are studying the possibility of doing so, like the United States, where a bill to this effect was tabled in 2021.(21)

Israel

In Israel, the purchase price is indexed to the CPI.(22) Thus, the portion of the nominal gain that is due to inflation is not considered when it is taxed. This method, which consists of taxing only the real gain, does not penalize those who hold assets for the long term more than those who hold them for a shorter period.

Once the asset has been liquidated, and after index-ation, the remaining amount, representing the real gain, is taxed at a fixed, non-progressive rate of 25% (in 2022).(23)

United States

In the United States, the taxation of capital gains currently depends on the holding period. If the asset is held less than 12 months, the gain is considered ordinary income. Otherwise, it is considered “long-term” capital and benefits from less burdensome taxation.(24) This method has the advantage of distinguishing between “speculative” (short-term) gains and gains from investment (long-term). The tax rate then de-pends on the taxpayer’s total income, as in Canada.

However, certain senators are proposing, in a bill tabled in 2021, to take inflation into account in the calculation of the taxable amount. The bill, entitled the Capital Gains Inflation Relief Act of 2021,(25) would index the purchase price to the GDP deflator.(26) One of the arguments put forward in the debate is precisely the fact that taxpayers can be required to pay tax on a nominal gain that in reality, taking inflation into account, represents a loss.(27)

Comparisons with Canada

How would Canada compare with these two countries, notably if the inclusion rate were increased to 75% or 100%, and if the proposed bill were eventually adopted in the United States?

Table 3 shows the taxes payable in each of the three countries, on a nominal gain of $50,000 realized on an initial investment of $100,000 held for 10 years. To facilitate the comparison, we assume that the CPI is the same in all three countries and corresponds to Canada’s from 2011 to 2021.

In the current context, the 50% inclusion rate allows Canadian taxpayers taxed in Quebec to pay less than those in the United States, but is much more burdensome than in Israel, whose tax system accounts for inflation.

In contrast, if the inclusion rate were raised to 75%, and even more so if raised to 100%, Canada’s tax system would become uncompetitive compared to its southern neighbour, with real effective rates of 62.7% and 83.6% respectively versus 58.1% in the United States. The same would be true if the United States decided to index the value to inflation, even if Canada maintained its current 50% inclusion rate (a rate of 41.8% in Canada versus 37.1% in the United States).

To remain attractive for foreign investment, Canada should therefore consider adjusting the calculation of the capital gains tax for inflation.

Adjusting Capital Gains for Inflation: A Source of Prosperity

The main benefit of such a reform, beyond the attractiveness of Canada for international investment, is to promote wealth creation.

Indeed, the capital gains tax is at the root of several distortions and harmful economic effects, such as an “immobilization” of investment (the “lock-in” effect). This prevents an efficient allocation of capital in the economy, since due to the capital gains tax, “investors have an incentive to keep their capital invested in a particular asset, even when it may not be the best use of the capital.”(28)

Taking inflation into account in the calculation of the tax tends to reduce this lock-in effect, thus improving the allocation and efficiency of capital in the economy,(29) and leading as a result to more intense economic activity(30) and an increase in the size of the economy. For example, according to estimates from the Tax Foundation in the United States, a tax reform to adjust capital gains for inflation would among other things result in a cumulative increase in American GDP of 0.11% in the long run.(31)

Conclusion

Taking inflation into account in the calculation of capital gains is a sensible economic measure that avoids taxing illusory “gains” and the confiscation of capital. This proposal, which is not a new one, is all the more urgent given that the Canadian economy is experiencing historically high inflation, hitting 5.7% in February 2022.(32) Taking inflation into account would be doubly necessary in order to preserve the tax competitiveness of Canada should the government decide to raise the inclusion rate.

The capital gains tax discourages investment and economic prosperity. Eliminating the inflationary distortion incorporated in this tax, notably for long-term investment projects, would encourage wealth creation.

Finally, adjusting capital gains for inflation should be at the heart of the debate in Canada if the United States goes ahead with the bill it has tabled in this regard.

The current situation is thus a particularly good opportunity to finally put an end to the inflationary distortions of the capital gains tax.

References

- Statistics Canada, “Consumer Price Index, February 2022,” The Daily, March 16, 2022.

- High inflation creates other fiscal distortions, for example, regarding corporate taxation. See Jack M. Mintz, “Inflation overstates corporate profits,” Financial Post, October 21, 2021.

- For recent examples, see Melville L. McMillan, “Should Canada’s Capital Gains Taxes Be Increased or Reformed?” Working Paper No. 2021-06, University of Alberta; Commission d’examen sur la fiscalité, Rapport final de la Commission d’examen sur la fiscalité québécoise, se tourner vers l’avenir du Québec, volume 1 : une réforme de la fiscalité québécoise, March 2015, p. 91.

- Les Macdonald, “Royal Commission on Taxation,” Canadian Encyclopedia, December 16, 2013.

- Government of Canada, Taxes, Income tax, Personal income tax, Reporting income, Line 12700 – Taxable capital gains, When do you have a capital gain or loss? January 18, 2022.

- Tommy Gagné-Dubé, Luc Godbout, and Suzie St-Cerny, Le traitement préférentiel des gains en capital : qui réalise les gains en capital au Québec ? Chaire de recherche en fiscalité et en finances publiques de l’Université de Sherbrooke, March 2015, p. 4.

- Ibid., p. 8.

- Desjardins, “2022 Personal Income Tax Rates – Québec,” December 10, 2021.

- The effective rate is thus 26.65%, or $533 of tax payable for a total gain of $2,000.

- Government of Canada, Taxes, Income tax, Personal income tax, Reporting income, Line 12700 – Taxable capital gains, Principal residence and other real estate, January 18, 2022.

- Government of Canada, Taxes, Income tax, Personal income tax, Claiming deductions, credits, and expenses, Line 25400 – Capital gains deduction, What is the capital gains deduction limit? January 18, 2022.

- Idem.

- Statistics Canada, op. cit., endnote 1.

- It would be possible, at least in theory, to minimize the impact of inflation, to estimate the value of the capital to be taxed each year, and to include the capital gain of the year just past in one’s income tax return, even if the capital was not sold. Such a system is complicated to put in place and no country applies it for all capital gains and all taxpayers. See Herbert G. Grubel et al., Unlocking Canadian Capital: The Case for Capital Gains Tax Reform, Fraser Institute, April 2000, pp. 110-129. Also, the very question of knowing if such unrealized “gains” represent income is open to debate. See for example Raymond L. Richman, Jesse T. Richman, and Howard B. Richman, “Accrued Gains Are Not Income: An Administratively Simple Rollover Treatment for Capital Gains Taxation,” International Journal of Economics and Finance, Vol. 12, No. 12, 2020.

- Amir Barnea, “The 50 per cent inclusion rate on capital gains benefits mostly the rich. It’s time to bump it up,” Toronto Star, September 26, 2022; Tommy Gagné-Dubé et al., La concentration réelle des gains en capital au Québec : une analyse longitudinale, Chaire en fiscalité et en finances publiques de l’Université de Sherbrooke, March 2021, pp. 3-10 presenting a summary of the current context, p. 7 and following; Michael Smart and Sobia Hasan Jafry, “Policy Forum: Inequity and Inefficiency in the Tax Treatment of Capital Gains,” Canadian Tax Journal, Vol. 69, No. 4, pp. 1172-1174; Megan Henney, “Biden proposes new minimum tax on billionaires, unrealized gains,” Fox Business, March 28, 2022.

- Tommy Gagné-Dubé, Luc Godbout, and Suzie St-Cerny, op. cit., endnote 6, p. 4. For a presentation of investors’ point of view on capital gains tax reduction and wealth creation, see John Dobson and Ian Soutar, “The Standing Senate Committee on Banking, Trade and Commerce Evidence, Ottawa,” February 23, 2000, in Herbert G. Grubel, op. cit., endnote 14, pp. 155-181.

- This example looks solely at the sale of shares by an individual resident of Quebec, and does not examine the sale of the assets used by the company. Moreover, it is not applicable to a taxpayer who is selling shares in the context of running a business.

- In order to simplify the calculations, the marginal rate was used, and no account was taken of personal deductions or credits to which the taxpayer could be entitled, nor of the possibility of using the capital gains deduction. It is also taken for granted that no choice was made in 1994.

- The real effective rate differs case by case; it depends on the holding period, the amount of the gain, and the inflation rate.

- Michelle Harding and Melanie Marten, Statutory tax rates on dividends, interest and capital gains: The debt equity bias at the personal level, OECD Taxation Working Papers No. 34, 2018, p. 29. Other countries cited in this regard are Chile, Mexico, Portugal, Greece, and Turkey.

- Ted Cruz, “Sen. Cruz, Rep. Davidson Introduce the Capital Gains Inflation Relief Act,” Press release, March 11, 2021.

- Worldwide Tax Summaries, Israel, Individual − Income determination, February 18, 2022.

- Idem.

- Erica York, “An overview of capital gains,” Tax Foundation, pp. 2-4.

- Ted Cruz, op. cit., endnote 22.

- 117th Congress, 1st Session, A Bill to amend the Internal Revenue Code of 1986 to provide for the indexing of certain assets for purposes of determining gain or loss, November 3, 2021, pp. 4-5. Contrary to the CPI, which reflects the evolution of consumer prices, the GDP deflator measures the prices of goods and services purchased by consumers, but also, notably, those paid by companies and public bodies. See on this topic for example US Bureau of Labor Statistics, “Comparing the Consumer Price Index with the gross domestic product price index and gross domestic product implicit price deflator,” Monthly Labor Review, March 2016.

- Erica York, op. cit., endnote 25, p. 6.

- Alex Whalen et Jason Clemens, “Correcting Common Misunderstandings about Capital Gains Taxes,” Fraser Institute, January 2021, p. 3.

- Frank Lochan, “Should Inflation Be a Factor in Computing Taxable Capital Gains in Canada?” Canadian Tax Journal, Vol. 50, No. 5, 2002, p. 1842.

- Ricardo de O. Cavalcanti and Andrés Erosa, “A Theory of Capital Gains Taxation and Business Turnover,” Economic Theory, Vol. 32, No. 3, September 2007, p. 493. The author, using a small business turnover model, concludes that production would increase by 0.26% if capital gains were indexed to inflation.

- Kyle Pomerleau, “Economic and Budgetary Impact of Indexing Capital Gains to Inflation,” Tax Foundation, Fiscal Fact No. 610, September 2018, p. 5.

- Statistics Canada, op. cit., endnote 1.