Viewpoint – Electric Vehicle Sales Quotas: A Tax in Disguise

The Quebec government has set itself the ambitious task of reducing greenhouse gas (GHG) emissions to 37.5% below their 1990 levels by 2030. In order to reach this target, important policy efforts have been devoted to the transportation sector, which accounts for 43% of total emissions. At the forefront of such efforts are electric vehicle subsidies. But starting with their 2018 models, carmakers will now also be faced with electric and hybrid vehicle sales quotas. This is a tax in all but name, which will disproportionately increase prices of conventional vehicles.

Media release: Consumers will pay the price for electric vehicle quotas

Related Content

Related Content

|

|

|

|

Setting electric car sales quotas is bad policy (Montreal Gazette, July 25, 2017) Quotas de voitures électriques: une taxe est une taxe (Huffington Post Québec, July 25, 2017) Voitures électriques : quand le chroniqueur prend le fossé (Le Soleil, July 30, 2017) |

Interview (in French) with Germain Belzile (Puisqu’il faut se lever, 98,5FM, July 25, 2017)

Interview (in French) with Germain Belzile (Martin Pouliot à BLVD, BLVD 102.1 FM, July 25, 2017) Interview (in French) with Germain Belzile (Duhaime le midi, FM93, July 25, 2017) Interview (in French) with Germain Belzile (Maurais Live, CHOI-FM, July 26, 2017) |

Interview with German Belzile (CTV News Montreal, CFCF-TV, July 26, 2017) |

This Viewpoint was prepared by Germain Belzile, Senior Associate Researcher at the MEI. The MEI’s Environment Series aims to explore the economic aspects of policies designed to protect the natural world in order to encourage the most cost-effective responses to our environmental challenges.

The Quebec government has set itself the ambitious task of reducing greenhouse gas (GHG) emissions to 37.5% below their 1990 levels by 2030.(1) In order to reach this target, important policy efforts have been devoted to the transportation sector, which accounts for 43% of total emissions.(2) At the forefront of such efforts are electric vehicle subsidies. But starting with their 2018 models, carmakers will now also be faced with electric and hybrid vehicle sales quotas. This is a tax in all but name, which will disproportionately increase prices of conventional vehicles.

Ambitious Targets

The policy enacted by the government targets carmakers whose sales in the province are above 4,500 vehicles per year. For 2018 models, these producers will have to accumulate a number of “credits” equal to 3.5% of their sales, increasing gradually to 22% in 2025. The accumulation of credits depends on the type of vehicle: For example, the sale or lease of a rechargeable hybrid car with 129 km of electrical autonomy is worth 1.3 credits, and fully electric vehicles are worth up to 4 credits. Carmakers that fall short will have to buy the missing credits. They will be able to acquire them either from other carmakers that have accumulated surplus credits or directly from the government. The price of one credit is set at $5,000.(3)

It is likely that carmakers will fall short of these targets. First of all, there were just 13,464 electric cars in Quebec in 2016, or roughly 0.26% of the total vehicle fleet, which is far from the stated objective of having 100,000 electric cars on Quebec roads in 2020.(4) Secondly, the quota of 3.5% for 2018 is above the present share of total motor vehicle sales that are electric and hybrid vehicles, which stands at 1.08%.(5) Moreover, certain carmakers produce no electric cars at all.

The Same Effect as a Tax

In economic terms, this quota will act just like a tax: It will increase the cost for a manufacturer of selling an additional conventional vehicle, and so the price that consumers must pay will also increase.

Consider the following example applicable to the 2018 model year, when the quota amount will be 3.5%. A producer who sells 7,500 vehicles would have to sell electric and hybrid cars in amounts sufficient to accumulate 262.5 credits.(6) If he falls short but decides to produce and sell 100 additional conventional vehicles, he will have to acquire an additional 3.5 credits, and the extra cost for these 100 vehicles will be $175 per vehicle.(7) This is the same marginal cost for each vehicle he sells as long as he is below the quota target.

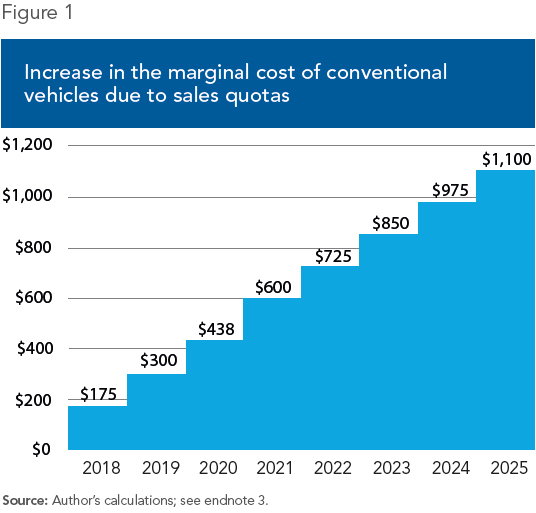

Moreover, as the quota increases to 22% by 2025, that extra cost will also increase to $1,100 per vehicle (see Figure 1). This increase in the marginal cost of conventional vehicles will be felt through higher prices for consumers, as it is the cost of the last vehicle produced that, combined with demand, sets the price of all vehicles.

In other words, there is a significant extra cost that will be passed on to consumers, putting upward pressure on car prices in Quebec and reducing car sales.(8) This is likely to be felt unevenly across the car market: It will represent a larger share of the total cost of a lower-end vehicle than a higher-end one. This means that poor households wanting to buy cheaper vehicles will face a steeper price increase than households with higher incomes acquiring more luxurious vehicles.

In addition, by evenly increasing the cost of all conventional vehicles regardless of their fuel efficiency, the affordability of light trucks will increase relative to passenger vehicles. This means that although there will be fewer conventional car sales, a greater share of these will be light trucks. Since the latter pollute more than the former, the quota policy is likely to encourage consumer responses that will mitigate the environmental benefits the government is trying to achieve by encouraging the electrification of Quebec’s fleet of vehicles.

Conclusion

The electric car sales quota is a tax that will eventually increase marginal costs by $1,100 per conventional vehicle. As such, consumers will end up paying higher prices. Even if the goal is to help Quebec reach its greenhouse gas emissions reduction goals, by encouraging a consumption shift toward less fuel-efficient light trucks, the policy might actually be environmentally counter- productive.

The only real winners from this policy will be carmakers that produce exclusively electric and hybrid cars and those with total sales below 4,500 that are not subject to the quota. They can still obtain as much as four credits per electric vehicle sold, most of which they would then be able to resell. At a cost of $5,000 per credit, this is the equivalent of a subsidy of $20,000 per car for these manufacturers, on top of the existing purchase subsidies for consumers, which are inefficient and costly in terms of reducing greenhouse gases.(9) Given these serious shortcomings, the Quebec government should think again and abandon its electric vehicle sales quota policy.

References

1. Department of Sustainable Development, the Environment and the Fight against Climate Change, “Québec adopts the most ambitious greenhouse gas reduction target in Canada,” Press release, November 27, 2015.

2. Sophie Brehain and Olivier Dominic Galarneau, “Transport – Véhicules électriques,” in Institut de la Statistique du Québec (ed.), Panorama des régions du Québec, édition 2016, Government of Quebec, p. 135.

3. Government of Quebec, Bill 104: An Act to increase the number of zero-emission motor vehicles in Québec in order to reduce greenhouse gas and other pollutant emissions, October 2016; Government of Quebec, “Règlement visant la limitation du nombre de crédits pouvant être utilisés par un constructeur automobile et la confidentialité de certains renseignements,” Gazette officielle du Québec, July 5, 2017; Government of Quebec, “Règlement sur la loi visant l’augmentation du nombre de véhicules automobiles zéro émission au Québec afin de réduire les émissions de gaz à effet de serre et autres polluants,” Gazette officielle du Québec, July 5, 2017; Government of Quebec, “Règlement d’application de la loi visant l’augmentation du nombre de véhicules automobiles zéro émission au Québec afin de réduire les émissions de gaz à effet de serre et autres polluants,” Gazette officielle du Québec, July 5, 2017.

4. Author’s calculations; Statistics Canada, CANSIM Table 405-0004: Vehicle registrations, 2016; Matthew Stevens, “Electric Vehicle Sales in Canada: 2016 Final Update,” Fleet Carma, February 8, 2017.

5. Note that even by making the most charitable assumptions regarding the amounts of credits accumulated, i.e., 1.3 for every hybrid and 4 for every fully electric vehicle, the industry as a whole will not be compliant with the 2018 quota, let alone individual producers. Author’s calculations; Statistics Canada, CANSIM Table 079-0003: New motor vehicle sales, Canada, provinces and territories, 2016; Matthew Stevens, op. cit., endnote 4.

6. The required number of credits are calculated by the percentage of the quota multiplied by the average number of cars sold for the model year (based on sales over preceding years).

7. Given the cost of $5,000 per credit, 3.5 credits would cost $17,500, or $175 per additional vehicle.

8. In fact, even the Department of the Environment acknowledges this when it points out that for 2019, this will impose a net cost of $30.5 million, although this study is based of unrealistic assumptions about the growth of demand in the automobile industry and especially for electric cars. Department of Sustainable Development, the Environment and the Fight Against Climate Change, Analyse d’impact réglementaire du projet de règlement d’application de la Loi visant l’augmentation du nombre de véhicules automobiles zéro émission au Québec afin de réduire les émissions de gaz à effet de serre et autres polluants, July 2017, p. ix.

9. Germain Belzile and Mark Milke, “Are Electric Vehicle Subsidies Efficient?” Economic Note, MEI, June 22, 2017.