Quebec Is Still a Corporate Subsidy Champion

Even though corporate subsidies have often been criticized for their undesirable economic effects and for discriminating in favour of certain sectors or companies, they continue to be very present in the Quebec economy. Quebec pays out twice as much in corporate subsidies as Ontario, proportional to the size of its economy. This policy does not make Quebecers richer.

Media release: Quebec is still a corporate subsidy champion

Related Content

Related Content

|

|

|

| Quebec: Still the subsidy champ (National Post, January 18, 2017)

Le Québec, toujours champion des subventions (Le Soleil, January 20, 2018) |

Interview (in French) with Alexandre Moreau (Midi Pile, KYK 95.7 FM, January 18, 2018)

Interview (in French) with Alexandre Moreau (Solide comme le Roch, FM 1047, January 18, 2018) Interview (in French) with Alexandre Moreau (Québec aujourd’hui, BLVD 102.1 FM, January 18, 2018) |

Interview with Alexandre Moreau (CTV News Montreal 12:00pm, CFCF-TV, January 18, 2018)

Interview (in French) with Alexandre Moreau (Mario Dumont, LCN-TV, January 18, 2018) |

This Viewpoint was prepared by Alexandre Moreau, Public Policy Analyst at the MEI. The MEI’s Taxation Series aims to shine a light on the fiscal policies of governments and to study their effect on economic growth and the standard of living of citizens.

Even though corporate subsidies have often been criticized for their undesirable economic effects and for discriminating in favour of certain sectors or companies, they continue to be very present in the Quebec economy.

Fifty Shades of Subsidies

Governments have at their disposal a multitude of measures and agencies to “support” economic development by targeting certain sectors, and sometimes specific companies:

- Transfer expenditures, which correspond to what are usually thought of as subsidies, are characterized by the fact that the government acquires no goods or services. These sums are also granted with no intention of obtaining a return or an eventual reimbursement. Private Quebec companies received more than $1.2 billion in transfer expenditures in 2016-2017.(1)

- Tax credits are advantages compared to the general tax structure aiming to encourage certain kinds of activities or certain kinds of companies. In 2016, these tax expenditures paid to private companies totalled $1.9 billion.(2)

- Interest-free or reduced-interest loans and portfolio investments totalled $5.7 billion in 2016-2017. These are generally granted under conditions that are more favourable than what the company would have obtained on capital markets. From the point of view of the government, the subsidy corresponds to the difference between the return obtained and what would have been saved if the amount granted had been used to reduce its debt. To this must be added the loss of capital if the company is not able to reimburse the loan or if the value of shares falls. However, the available data do not allow for a precise determination of the annual cost of this kind of subsidy.(3)

- Finally, the government can also offer loan guarantees to companies. As of the 2016-2017 fiscal year, the Quebec government registered a total of $6.8 billion in loan guarantees. Thanks to this guarantee, the company gets a lower interest rate than it would have obtained on the market. The subsidy corresponds to the loss provision that the government sets up to cover non-refunded loans. The available data do not allow for an evaluation of the annual cost of such subsidies.(4)

The total corporate subsidies granted by the Quebec government, calculated based on the public accounts, thus come to a minimum of $3.1 billion in 2016-2017, while government receipts from taxing the income and the capital gains of private companies amounted to $7.5 billion.(5) This means that for each dollar the government collects from private companies, at least 41 cents are spent on various forms of subsidies. Given that the amounts of certain kinds of subsidies cannot be evaluated precisely, as explained above, the real figure is likely higher.

19% of GDP, 29% of Subsidies

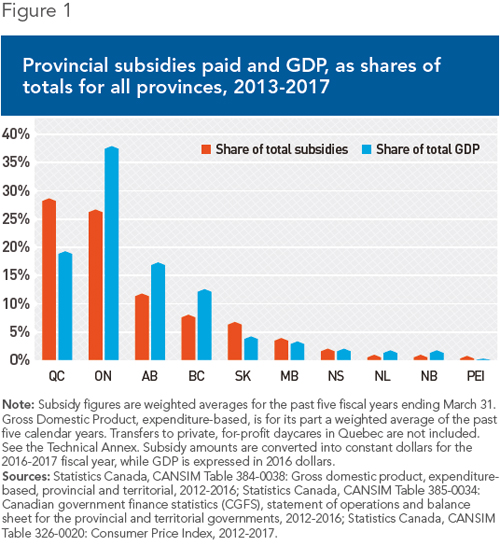

Statistics Canada counts subsidies to private businesses, which makes it possible to compare provinces. Using a methodology that differs slightly from the one we used for our Quebec estimate, the data show that corporate subsidies occupy a particularly significant place in the Quebec economy. For every $100 generated by its economy, the government spends 86 cents on various forms of subsidies. For provinces like Ontario, Alberta, and New Brunswick, the corresponding amounts are just 40, 39, and 29 cents respectively.(6) Thus, while Quebec produces just 19% of the provinces’ total GDP, it grants nearly 29% of the subsidies paid out by them (see Figure 1).

This disproportionate use of subsidies by the Quebec government does not result in a higher level of wealth per capita. In 2016, Quebec’s GDP per capita was $47,443, compared to $74,343 in Alberta and $58,585 for the provinces not including Quebec.(7)

Supporting the economy with subsidies is not a winning recipe, since such a high level of intervention entails adverse effects that undermine growth.(8) Increasing taxes to finance these subsidies creates distortions in the economy, reduces households’ purchasing power, and discourages productive activities. Recent studies estimate that each dollar collected in taxes costs society from $1.10 to $5.00. Moreover, these are costs that recur each year and that tend to be amplified over time.(9)

Also, the existence of subsidies gives rise to “rent-seeking.” Instead of trying to be more competitive and better satisfy consumers, entrepreneurs have an incentive to spend time and resources to try to collect their share of subsidies. For their part, politicians have an incentive to use subsidies to help certain sectors or companies to which voters are more attached, without regard for their economic viability, in order to increase their chances of being re-elected.(10)

By behaving in this way, the government essentially ends up confiscating money from more successful companies to spend it on projects that are relatively or completely unprofitable. Even if it manages to turn a profit from such activities, the government thereby politicizes entrepreneurship, which prevents an optimal allocation of resources.

The harmful effects related to the collection of taxes and their redistribution in the form of subsidies have been known for a long time. The Quebec economy would be in much better shape if the government substantially reduced corporate subsidies, and in return, reduced the corporate tax burden as well. Such a reform would not have a significant effect on public finances, but it would improve the competitiveness of all companies, reduce economic distortions, and promote wealth creation.

References

1. Quebec Finance Department, Public Accounts 2016-2017, Volume 2—Financial Information on the Consolidated Revenue Fund: General Fund and Special Funds, November 2017, pp. 11, 12, 42, and 43.

2. Quebec Finance Department, Public Accounts 2015-2016, Volume 1— Consolidated Financial Statements of the Gouvernement du Québec, November 2017, p. 100.

3. This amount includes the government’s $1.3-billion participation in specific funds entrusted to the Caisse de dépôt et placement du Québec. Ibid., pp. 92-93, 104-106.

4. Over 70% of the loan guarantees concern producers in the forestry, farming, and fishing sectors through the Financière agricole du Québec. The other guarantees were granted by the Economic Development Fund that is managed by Investissement Québec, including the program aiming to facilitate the funding of aircraft purchasers. Ibid., pp. 145-146.

5. Ibid., p. 166.

6. If Quebec subsidized its companies at the same level as the other provinces, the amount of subsidies paid out by the government would be on the order of only $1.7 billion. Annual estimate based on the weighted average of the five past fiscal years.

7. This gap is significant, despite the fall in oil prices experienced in 2014, which contributed to a $17,300 drop in Alberta’s GDP per capita. See the Technical Annex on the website of the MEI.

8. Nathalie Elgrably, “Are Business Subsidies Efficient?” Economic Note, MEI, June 2006.

9. Mathieu Bédard, “Cutting Public Spending Promotes Economic Growth,” Economic Note, MEI, October 8, 2015.

10. Gordon Tullock, “The Welfare Costs of Tariffs, Monopolies, and Theft,” Western Economic Journal, Vol. 5, No. 3, June 1967, pp. 224-232; Matthew Mitchell, “The Pathology of Privilege: The Economic Consequences of Government Favoritism,” Mercatus Center at George Mason University, July 2012, pp. 17-19.